How to Open a Bank Account Overseas: The Easy Way 2026

Looking to open a bank account overseas? Whether you've just landed in another country or you're planning everything ahead of your arrival, opening a bank account abroad can be a complex process.

This article will help you understand how to open an overseas account abroad, or remotely before you travel, including the documents you need. We’ll also look at a few of the options available including flexible multi-currency account services such as Wise or Revolut. But more on that later, read on.

Which account is best for foreigners living abroad?

If you’re an expat, or living overseas to study or work, having a flexible account you can use to hold and spend in several different currencies can be very handy. Opening an account in your new home country may not be possible before you arrive, or even immediately upon arrival, as traditional banks often need a local proof of address. That can take a while to sort out - and you’ll still need a way of managing your money while you pull the paperwork together.

Alternative account providers and neobanks can offer a great alternative to traditional banks. Providers like Wise, Revolut and Monese offer accounts you can open from a range of countries, so you can set up your account before you travel using your regular proof of address documents. Once you have an account set up you’ll be able to use it to hold and spend in one or more currencies, including getting your hands on a linked debit card, and accessing low cost international transfers and currency exchange.

Let’s take a look at how Wise, Revolut and Monese measure up across some important account features.

| Service | Wise | Revolut | Monese |

|---|---|---|---|

| GBP and USD account options | Yes 50+ currencies supported | Yes 30+ currencies supported | No GBP, EUR and RON only |

| Open before you move country | Yes - open with proof of address from all but a small selection of countries | Yes - open with proof of address from the US, EEA, Australia and a selection of other countries | Yes - open with proof of address from the UK or EEA |

| Open online | Yes | Yes | Yes |

| Opening fee | £0 | £0 | £0 |

| Fall below fee | £0 | £0 | £0 |

| Maintenance fee | £0 | £0 - £12.99/month depending on plan | £0 - £14.95/month depending on plan |

| International transfers | Low fee from 0.41%, based on currency | Low fee, usually 0.3% - 2% discounted for some paying account plans | Up to 2% fee, depending on plan selected |

| Close account fee | £0 | £0 | £0 |

The good news with specialist account services is that you can open your account and get started online or through an app - which means you don’t even need to leave home. Providers like Wise, Revolut and Monese also have relatively flexible eligibility criteria so you can open your international account from a selection of countries. Compared to regular banks you’ll often get lower fees, and a better selection of multi-currency and international services, which can be very useful if you’re living overseas.

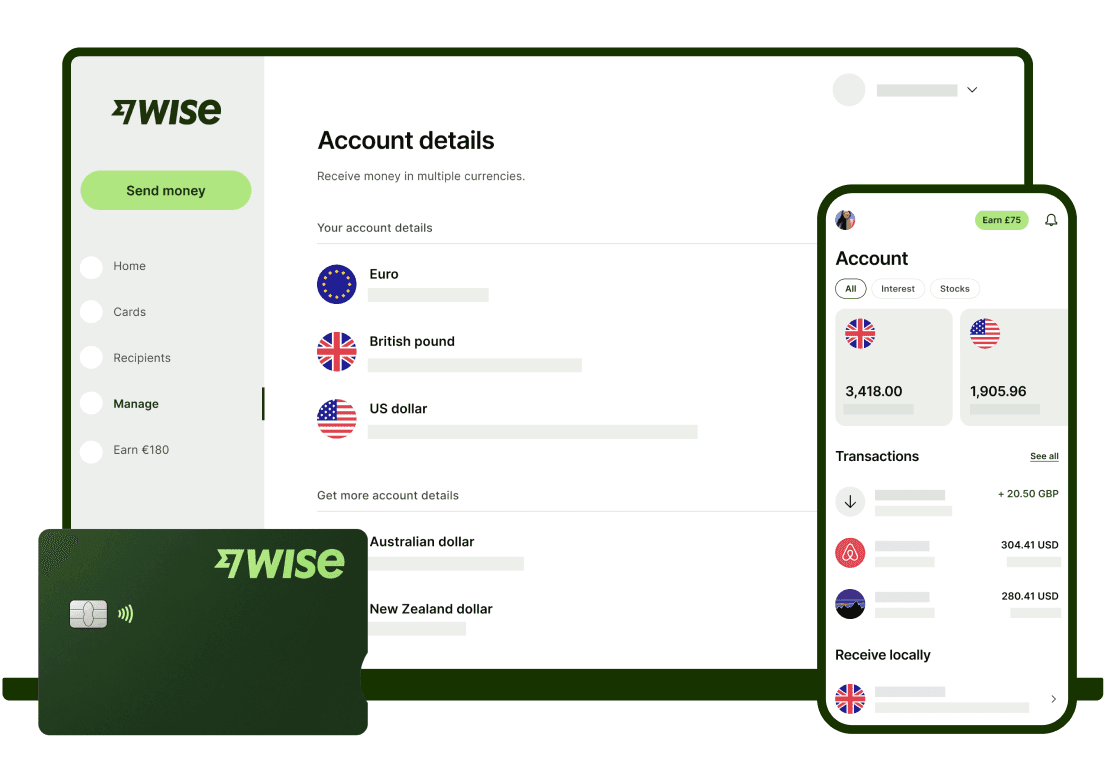

Wise

Wise is a financial technology company which offers multi-currency accounts for personal and business customers in a broad range of countries. You can set up a Wise personal account online or in the Wise app, with no account opening or maintenance fee, to hold and exchange 50+ currencies. Order yourself a Wise debit card for easy spending, get local account details to receive fee free payments in up to 10 currencies, and send payments around the world with the Google exchange rate and low, transparent fees.

Fees: No fee to open a personal account, no maintenance fee. Currency conversion uses the mid-market exchange rate with fees from 0.41%

What to watch out for: Fees do apply to open a business account, and you’ll pay 7 GBP to get your Wise debit card. You’ll also pay a fee when making some ATM withdrawals - while all Wise account holders can make up to 2 withdrawals, valued at up to 200 GBP/month fee free, there are charges of 0.5 GBP + 1.75% after that. Fees and charges vary based on the country you live in, so do check the terms carefully

Eligibility: Wise is available to customers in all but a small handful of unsupported countries. Just use your normal proof of identity and address to open your account online or in the Wise app

Revolut

Revolut calls itself a financial super app, and offers personal and business accounts which have a good range of features. As well as multi-currency functionality and linked spending cards, you’ll also be able to earn interest and get insurance and payment protection on some account tiers. Revolut offers free standard accounts, or you can upgrade to a fee paying account tier which comes with more features and higher fee free transaction limits. All account tiers can get some currency exchange with the Google exchange rate - the higher account tiers can access unlimited fee free exchange, although some out of hours and exotic currency charges may still apply.

Fees: Choose an account with no monthly fee, or upgrade to one of several different fee paying tiers, with charges up to 12.99 GBP/month. All accounts come with some fee free transactions, although these are more limited on the standard plan, which means you need to pay a fee to unlock the full features of the account. Fees and charges vary based on the country you live in, so check the account terms carefully

What to watch out for: Revolut accounts have fairly clear pricing, but it’s important to consider whether the extras you get from a fee paying tier are worthwhile based on the way you expect to use your account. There are also a couple of extra costs to understand, including out of hours and exotic currency fees which apply when converting your balance or sending international payments

Eligibility: Apply online or in the Revolut app, using your proof of legal residence from the European Economic Area (EEA), Australia, Singapore, Switzerland, Japan or the United States

Read a full Revolut review here

Monese

Monese supports accounts which can be used to hold and exchange GBP, EUR and RON. You’ll need to be a resident in the UK or EEA to get your account set up, but the process is fairly painless and can be done online or in the Monese app for convenience. Joint accounts are available, as well as specific credit building products. The features and limits you get from Monese will depend on the account tier you select, with more limited options on the free basic plan.

Fees: Fee free plans are available or you can upgrade to an account tier with more features, for up to 14.95 GBP/month. Standard plan customers have limited fee free foreign currency spending and ATM withdrawals

What to watch out for: Monese accounts can be handy if you’ll be primarily spending in one of the 3 supported currencies, but account limits are pretty low on the standard plan if you’re expecting to spend overseas. This can push up costs when you travel or make cash withdrawals

Eligibility: Apply for a Monese account from the UK or EEA only

What documents do I need?

Exactly what you need to open a bank account will depend on the country the bank is based in, and your own country of residence. However, as global financial regulations are alike, the requirements to open a bank account overseas can look pretty similar to what you’ll be asked to provide when opening a bank account in the UK.

To open a bank account overseas you’re likely to need:

A government issued photo ID document, like a passport

Proof of your residential address - often a recent utility bill or bank statement in your name

Some account types have other requirements, such as a local credit history, or proof of employment or student status, too. In a handful of countries you may meet even more restrictive requirements, like having a local friend who can vouch for your trustworthiness.

Save the paperwork with alternative solutions like Wise or Revolut

If you’re planning your move overseas - or if you’ve just arrived in your new country - you may not have all the paperwork needed by a local bank to open an account. Instead, check out a specialist provider like Wise or Revolut, which offer flexible multi-currency accounts you can open online from a broad range of countries.

You’ll just need to show your normal ID and a proof of address from your home country, to get your account set up online or in the provider’s app. And once you’re all set up, you can hold, exchange, send and spend in one or more currencies, to make it easier to settle into your new home.

We’ll look in more detail at how Wise and Revolut work, including features, fees and eligibility in just a moment.

How to open a bank account abroad

Exactly how you can open an overseas bank account will depend a bit on the country you’re moving to. In some countries, opening an account with a traditional bank can be done online - but it’s still surprisingly common to be asked to visit a branch in person to present your paperwork and sign documents.

Don’t expect the account opening process to be the same as you’ve experienced at home - and give yourself plenty of time to work through the bureaucracy if you pick a traditional bank.

Can I open a bank account overseas before arrival?

Different countries and different individual banks also have their own conventions on who can open an account. Often you’ll find there’s no legal reason why you can’t open an account before you’re a resident in your new country, but banks are reluctant to provide non-resident accounts because it’s an extra hassle for them.

Elsewhere, in countries like Canada and Australia, you may find banks that allow you to start the account opening process before you travel - but you won’t actually be able to get full account functionality until you’re a legal resident and can visit a branch in person.

In most cases, you’ll find it far easier to get your new overseas bank account set up if you pick a specialist provider instead - more on that next.

What are the costs?

The costs of opening and operating a bank account abroad can vary widely. In some countries it’s common to find accounts which don’t have any ongoing fees or maintenance charges - but in other destinations, you’ll find most accounts have a basic ongoing charge no matter how often you use the account. On top of this, you’ll normally pay service charges when you withdraw money from an ATM, make a payment or have funds deposited to your bank account.

Because the fees involved in managing your money can vary very widely depending on the country you’re in and the specific account type you select, it’s really important to go through the account terms and conditions thoroughly before you get started.

Tips for transferring money

If you’re moving overseas, the chances are that you’ll need to transfer money internationally, to cover bills back home, receive salary payments, or pay a deposit on your new home. International transfers with normal banks can be pretty costly - including several different fees. Don’t spend more than you need to when sending an international payment - here are a few tips to help you save:

Compare your bank’s exchange rate with the rates on Google - often extra fees are hidden here, which push up the costs

International transfer fees can vary widely, based on where you’re sending to, and the way you set up your payment. Online transfers are almost always the cheapest option

Third party SWIFT fees may be deducted as the payment is processed, and can mean your recipient gets less than you expect

Using a specialist provider is often cheaper than a normal bank, and can also mean you get a better exchange rate

To get the best deal on international payments you’ll need to shop around a bit for the best rates and fees on your specific transfer. Using a specialist - or opening a multi-currency account like those on offer from Wise and Revolut - can cut your costs significantly.

Conclusion

If you’re moving overseas, getting a bank account will be a priority - but it can also be a huge hassle. Instead of using a traditional bank in your new country, consider getting a specialist account from an online provider or neobank, which can often mean more flexible account options, cheaper overall fees and more international services to choose from.

FAQ - How to open an account overseas

Different banks have their own eligibility policies, which can mean it’s tricky to open an account if you’ve not got a proof of legal residence document. One alternative is to pick a specialist multi-currency account, which can often be opened before you travel, and used to hold the currency - or currencies - you need.

It’s often free to open a bank account, but you may find you have to pay ongoing maintenance fees and transaction charges. Look through the account fee schedule carefully to avoid surprises.

The easiest way to open an account online which can be used to hold foreign currencies, is to pick a multi-currency account from a specialist provider. Traditional banks may require you to visit a branch to get your account up and running, and almost all will need you to have a local proof of residence in the country they’re based in.

Most traditional banks need a local proof of address before they’ll offer account services, which can make it hard to get your account arranged in advance. As an alternative, look at specialist services like Wise and Revolut, which can offer accounts to hold and exchange foreign currencies, with a proof of address from your home country.