Wise Multi-Currency Account Review: Fees, Pros and Cons 2026

Wise was launched in 2011 and makes it cheaper, faster and easier to send international transfers, thanks to a radical new payment model.

Today, Wise serves over 16 million personal and business customers with cross-border payments, and the Wise multi-currency account. If you receive, send or spend foreign currencies, the Wise account can help you save money with low, transparent fees and the real exchange rate.

This guide covers all you need to know about the Wise multi-currency account to help you decide if it’s right for you.

Wise Account: Key points

Key features:

Hold and exchange 40+ currencies

Spend and withdraw in 170+ countries with your linked debit card

Send money within the UK and to 160+ countries

Receive money fee free from 30 countries with your own local bank details

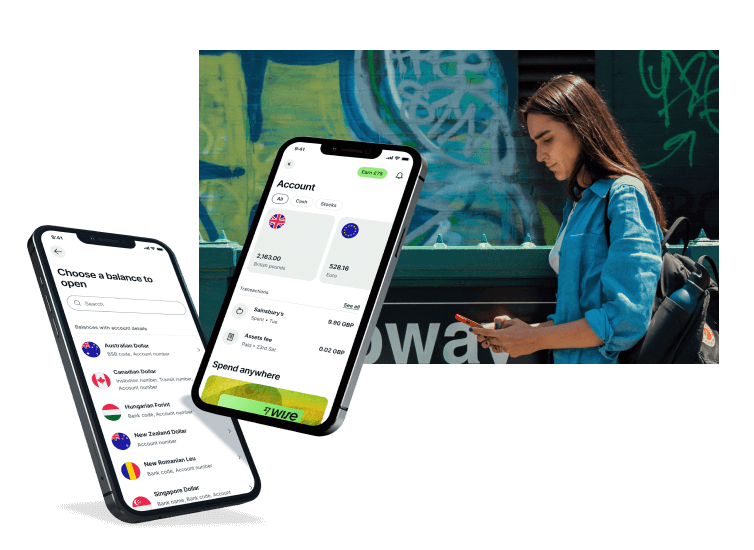

See account balances in a glance, and manage your account in the Wise app

Instant transaction notifications for security

Pros:

Price: No monthly fee, and low transaction charges - often the cheapest option available

Exchange rate: No exchange rate markup or foreign transaction fee applied

Speed: 80% of payments arrive within 24 hours and 35% of the total are instant

Convenience: make payments online or in the Wise app in just a few clicks

Transparency: full visibility on all fees, plus a delivery estimate when you make a payment

Manual and automatic anti-fraud processes

Cons:

Wise is not a bank - not all features you’d expect from a bank account are available

You can’t pay in cash to your account

No credit or overdrafts available

No branch network - service available online, in-app and by phone only

Overall: The Wise multi-currency account has a broad range of features, with no ongoing charges or minimum balance. Hold and exchange 40+ currencies, send payments to 160+ countries, and spend all over the world with the mid-market exchange rate using your linked Wise card. Unlike banks, Wise offers international payments and currency conversion with low, transparent fees and no exchange rate markup.

What is the Wise account and how does it work?

The Wise multi-currency account is an easy, low-cost way to receive, exchange and send foreign currency payments.

You can also spend and make cash withdrawals with your Wise international debit card, which is Google Pay and Apple Pay compatible for mobile payments around the world. Because Wise offers the mid-market exchange rate without markups, and without foreign transaction fees, you’ll often find the overall costs are market beating.

Receive money with Wise

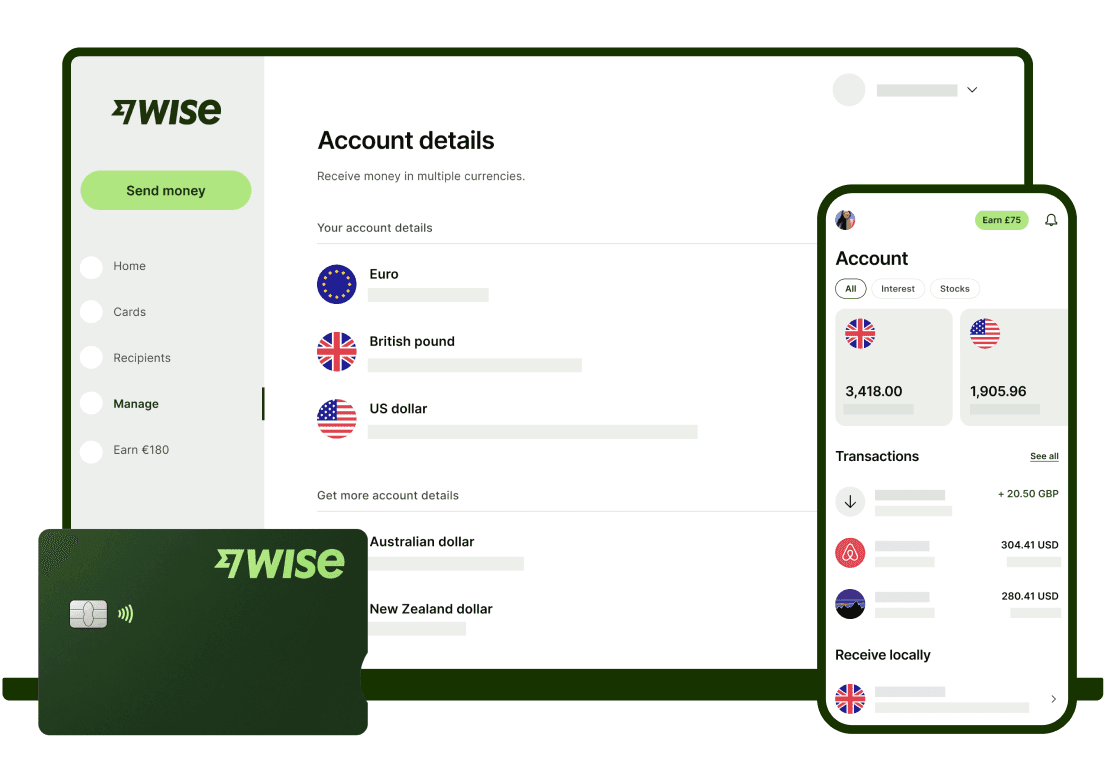

When you open your Wise account you’ll be able to access local bank account details for 9 currencies including GBP, USD, EUR, AUD and NZD. Give these account details to people who want to send you money from overseas, to receive payments into your Wise account fee free from 30 different countries.

Hold money with Wise

You can use your Wise account to hold 40+ different currencies, and you’ll see all your balances in a glance on the Wise app or by logging into your account online. It’s always free to spend any currency you hold with your Wise international debit card, and you can also exchange between currencies with the mid-market rate and low, transparent fees as and when you need to, in just a few clicks.

Wise is an FCA authorised and regulated provider.

Spend with a Wise card

Spend and withdraw in 170+ countries with no foreign transaction fees, with a Wise international debit card. You can order your physical card for a one time fee of 5 GBP, and get started transacting right away with a Wise virtual card. Add your card to Google Pay or Apple Pay for easy mobile payments.

Smart auto-convert technology means that you’ll always pay in the local currency wherever you are. If you don’t hold the right balance your card can convert it for you in the cheapest possible way, to make sure you don’t get caught out by hidden fees applied by merchants using dynamic currency conversion. You’ll also get instant transaction notifications when you spend and you can freeze and unfreeze your card in the Wise mobile app for security.

Transfer from your account

If you hold a Wise balance you can withdraw it to a local account or make international payments to 70+ countries. If you don’t have the currency you need for your transfer, you’ll get the mid-market exchange rate when you send your payment, with low, transparent transfer fees. Simply log into your account and tap Send money to get started.

It’s good to know you can also set up GBP, EUR and AUD direct debit payments to set it then forget it for recurring bills around the world.

Convert money on Wise

Within your Wise account you can convert between 40+ currencies using the mid-market exchange rate with no markup. You’ll just pay a low currency conversion fee which is typically around 0.35% of the value of the transaction for major currencies.

Invest on Wise (Wise Assets)

Wise UK customers can also benefit from Wise Assets, which allows you to hold your balance in investments and retain instant access to your cash when you need it. Your money will be invested in stocks via an index tracking fund which tracks the value of hundreds of the world’s best companies including Apple, Google and Tesla.

As with any investment, the value of the fund can go down as well as up. However one advantage of an index tracker is that your money is split between hundreds of different stocks - this can reduce the impact on your investment if one particular company loses value. Read more about Wise Assets here.

*Capital at risk - Growth not guaranteed

Wise multi currency account fees

Here are the key fees you’ll want to know about when you open a Wise multi-currency account:

Service | Wise fee |

|---|---|

Open your Wise multi-currency account | Free |

Hold 47 currencies | Free |

Get local bank details for 9 currencies | Free |

Order a Wise debit card | 5 GBP |

Spend currencies you hold using your card | Free |

First 2 ATM withdrawals up to 200 GBP/month | Free |

ATM withdrawals over 200 GBP/month | 1.75% |

Over 2 ATM withdrawals/month | 0.50 GBP/withdrawal |

Convert a currency using your card | Low fee - around 0.35 % is common for major currencies |

Receive money in EUR, GBP, AUD, NZD, RON, HUF & SGD | Free |

Receive USD by ACH or bank debit | Free |

Receive USD by wire | 7.50 USD |

Send international payments | Low currency conversion fee - around 0.35 % is common for major currencies + fixed fee which varies by currency |

GBP, EUR and AUD direct debits | Free |

Get a full rundown of the Wise multi-currency account and debit card fees here or learn about Wise's fees in general here.

Is it safe to keep money in Wise?

There are many different manual and automatic processes in place to keep customers and their money safe, including:

Customer funds are safeguarded and kept separately from Wise’s own funds

Wise holds a fixed level of capital on hand at all times

Regular stress testing exercises to check plans and processes are robust

24 hour support with dedicated anti fraud teams and technology

Account verification processes and 2 factor authentication

Instant transaction alerts, with the option to freeze your card in the Wise app

Read more about Wise safety here.

Is TransferWise a bank?

Wise is not a bank, it's an e-money institution.

Wise is authorised by the FCA in the UK. That means it’s subject to the same regulations as other financial services providers, both in the UK and in all the other countries it operates in.

As a financial technology company, Wise has built its services and platforms with security in mind, to keep customers safe while offering an intuitive way of managing your money.

Wise Pros

Hold 40+ currencies and see them all at a glance

Mid-market exchange rate and low transparent fees when you send or convert

Spend and withdraw with your physical or virtual Wise card

Get paid like a local from 30 countries

Overseas payments to 70+ countries

Invest through Wise and retain access to your funds

Safe and regulated provider in the UK and overseas

Wise Cons

No branch service - online, in-app and by phone only

No cash deposits

Transaction fees may apply

No interest on Wise funds held in cash

Who is the Wise multi currency account for?

The Wise multi-currency account can be opened by both personal and business customers, and suits a broad range of people.

Wise personal multi-currency accounts may suit customers who:

Travel often, and need to pay for goods and services in foreign currencies

Shop online with international retailers

Get paid from overseas - freelancers and contractors for example

Pay regular bills internationally, like an overseas mortgage on a holiday home

Manage their money online and on the move

Want to invest in an index tracking fund but retain instant access to cash

Wise business accounts may suit customers who:

Pay suppliers and contractors based abroad

Manage payroll internationally through one off or batch payments

Receive money from customers and clients based overseas

Withdraw in foreign currencies from PSPs like Stripe or marketplaces like Amazon

Want to reconcile their international account with cloud-based accounting software

Need international debit cards for their team and want to set and manage user permissions

How to open a Wise account

Opening a Wise multi-currency account is easy and can be done entirely online.

Open the Wise homepage or app

Click Register

Follow the prompts to enter your personal details

Get verified

You’re ready to go

Go To Wise

What documents you'll need

To comply with the law in the UK and around the world, you’ll need to get verified to open a Wise account. This helps keep customers and their money safe by preventing fraudulent or criminal use of accounts. The exact steps you need to take will depend a little on the account type you’re opening, and the information you provide - but a member of the Wise team will always guide you through if you need help. You can also save and exit the process if you don’t have everything on hand at first.

To open a personal Wise multi-currency account you’ll usually need to provide:

Proof of your identity - like a passport or driving licence

Proof of address - like a bank statement or utility bill in your name.

You may be asked to take a selfie with your documents to show your identity matches your paperwork.

Customers looking to open a Wise business multi-currency account will need to provide business documentation which can vary based on entity type, as well as the names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business.

How long does verification take

Account verification can happen on the same day or even instantly for many customers. The Wise service team aims to have all accounts verified within 2 days and will be in touch if any more information or documentation is needed to get your account up and running.

Wise (TransferWise) limits

Both individuals and businesses around the world trust Wise with high value international payments. As such, the Wise transfer limits are set fairly high, at the equivalent of about 1 million GBP per transaction for most currencies. If you need to send more you can always contact the customer service team for guidance.

Here are the Wise transfer limits for a few major currencies as an example:

Sending | Maximum payment |

|---|---|

EUR | 1.2 million EUR |

USD | 1.6 million USD |

AUD | 1.8 million AUD |

CAD | No limit |

SGD | 2 million SGD |

Conclusion

The Wise multi-currency account offers flexible, low cost ways to hold, send and receive foreign currencies. Because Wise uses the mid-market exchange rate and low fees, the overall costs are often the cheapest on the market for international payments - and thanks to Wise’s modern approach to processing payments, they’re often among the fastest, too.

The Wise account is available to individuals, business owners and freelancers who need to pay and get paid internationally, and can make it cheaper and easier to manage money across borders.

FAQs

There’s no cost to open a Wise account, and no monthly fees to pay. Some transaction charges do apply, which are low and transparent.

Many Wise transfers are instant or arrive within 24 hours. You’ll see a delivery estimate when you arrange your payment.

Wise is a safe and reliable provider for sending money internationally.

All currency exchange with Wise uses the mid-market exchange rate with a low conversion fee. This can be around 0.35% for major currencies.

Yes. Get the Wise app on both Apple and Android phones.

Open a Wise account online or in the mobile app to hold, send and receive foreign currencies. You can also get a linked Wise debit card to spend and make withdrawals around the world.

Send payments to 70+ countries, hold 40+ currencies, and get bank details to get paid like a local in 9 currencies to your Wise multi-currency account.

General advice: The information on this site is of a general nature only. It does not take your specific needs or circumstances into consideration. You should look at your own personal situation and requirements before making any financial decisions. We compare currency exchange and money transfer services in over 200 countries and territories worldwide. We only display reputable companies which we have researched and approved.