Wise Card Review UK: All You Need to Know 2026

Wise launched in 2011 with a mission to challenge the banks and make transacting internationally cheaper, faster, and easier - with no hidden charges or sneaky exchange rate hikes.

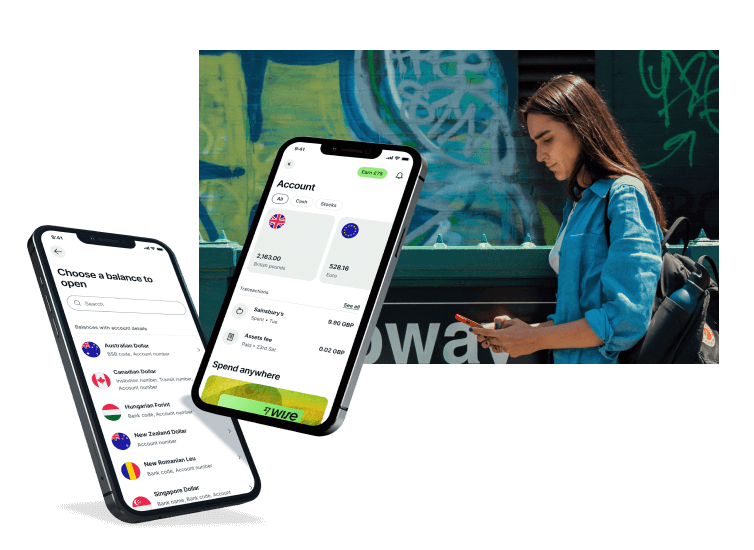

Wise offers a range of products including instant low fee international payments, multi-currency accounts, and Wise debit cards for personal and business customers.

This Wise debit card review covers all you need to know about the Wise card features, fees, availability and more.

Quick summary

There’s an in-depth Wise debit card review coming up - first let's look at the key features, pros and cons of the Wise debit card for personal or business users.

Wise debit card features

Hold and exchange 40+ currencies in your Wise account

Spend in 200+ countries, withdraw at 2.3 million ATMs

Convert currencies in your account with the mid-market exchange rate and low fees

Virtual cards available instantly

View and manage your account in the Wise app

Freeze and unfreeze your physical card and virtual cards instantly

Pros of the Wise debit card

No ongoing card charges to pay

Free to spend any currency you hold in your account

Auto convert function to cut costs even if you don’t have the currency you need

2 free ATM withdrawals, to the value of 200 GBP per month, with low fees after that

Get up to 3 virtual cards for easy spending and budget management

Not a credit card - no risk of interest charges creeping in

Personal and business cards available

Cons of the Wise debit card

One time 5 GBP fee to get your card in the first place

Some ATM fees apply when you make 3 or more withdrawals, worth more than 200 GBP/month

Daily and monthly limits based on spend category

Top up account online or in app only - no cash or cheque options

No credit facilities

Who is the Wise debit card for?

The Wise debit card is available in the UK for both personal and business customers, which means it can be a great way for lots of people to manage their money conveniently - and cut transaction costs at the same time.

The Wise card is great for:

Travellers looking to make contactless or mobile payments

Anyone on holiday who wants to withdraw cash cheaply from local ATMs

People who love to shop online with international retailers

Anyone who wants a low cost, secure account with both virtual and physical cards

Entrepreneurs who need to spend in foreign currencies

Business owners who want to offer international debit cards to team members to manage spending and expenses

Is the Wise travel card a good option?

Wise is intent on revolutionising the way people and businesses transact internationally, to make it cheaper, faster and more convenient compared to banks.

The debit card that comes with your Wise account can be used as a travel card as it’s been optimised for international features, and with a focus on keeping fees low and your options flexible. Here’s how the Wise card can shine as a travel card:

- The Wise card is secure and not linked to your regular bank account in GBP

- You’ll be able to hold 40+ currencies, to convert in advance of spending if you like

- You can use your Wise card to make cash withdrawals so you don’t need to arrange your travel money in advance

- No monthly fee, no maintenance fee

- Wise currency exchange always uses the real mid-market exchange rate with no markup

How do Wise travel card fees compare for spending abroad?

In the UK, spending with a Wise card could be up to 88% cheaper compared to using your regular bank’s debit card. That means you could save considerably, every time you use a Wise debit card to shop when you travel, spend with international ecommerce stores, or make a cash withdrawal overseas.

Wise card vs bank card

To give an overview, here’s how the Wise debit card compares with some major UK high street banks when spending in euros from a debit card linked to a GBP denominated account:

| Provider | Transaction fee (including the FX markup) |

|---|---|

| Wise | 0.35% |

| HSBC | 2.75% |

| Barclays | 2.99% |

| Lloyds | 2.99% + 0.5 GBP per transaction |

| NatWest | 2.75% |

This data was last updated on 22.03.2022. All fees are provided for standard accounts and debit cards. Learn more here.

What is a Wise card?

The Wise card is a debit card - not a credit card - that’s linked to a Wise multi-currency account. It’s great for spending and making cash withdrawals, online, at home and abroad - and best of all, you’ll get currency conversion using the real mid-market exchange rate whenever you choose to spend in a foreign currency.

Make payments and withdrawals in 200+ countries

Use 2.3 million ATMs for withdrawals, all around the world

Top up in the currency you prefer and check your account balances at a glance in the app

Switch currencies with the real exchange rate and low, transparent fees

Spend any currency you hold in the account for free

Auto convert feature makes sure you always pay the lowest possible fee when spending currencies you don’t hold in your account

Instant transaction notifications for security

Get instant access to 3 virtual cards

Freeze and unfreeze your card whenever you need to

Debit card - making it easier to manage your budget without running up debts or incurring credit charges

Wise virtual card

The Wise virtual card - also known as the Wise digital card - allows you to make payments online and in stores with your phone. Simply add your virtual card to a mobile wallet like Apple Pay or Google Pay, to make contactless payments in stores and buy things online. You can have up to 3 virtual cards at any one time which can make it easier to manage your budget by assigning different spending types to different cards.

Wise virtual cards have different card details to your physical card, and can be frozen instantly whenever you’re not using them - offering a handy added layer of security. You’ll be able to start using your Wise digital card as soon as you order your physical card, with no need to wait for the physical card to be delivered.

How does the Wise debit card work?

The Wise international debit card is linked to a Wise multi-currency account, which lets you hold, exchange, receive and send payments in 50+ currencies. Order a linked Wise debit card to make it easier to spend and make cash withdrawals from your Wise account balance, all over the world.

It’s always free to spend currencies you hold in your account. And if you don’t have the currency you need in your account, the Wise debit card can automatically convert the amount for you from whichever available currency account has the cheapest conversion fee. That means that there’s no need to worry about converting money before travelling, because you’ll always know you’re getting the best available deal every time.

Wise card limits

Your Wise card comes with default set limits which you can change if you would like to. Daily and monthly limits apply - daily limits refresh each day at midnight, while monthly limits restart on the first day of each calendar month. If you’re not happy with the default limits it’s easy to change them to suit you - just log into your account on the Wise app or desktop site.

First, here’s a rundown of the standard Wise personal debit card limits by transaction type:

| Transaction type | Single transaction limit | Daily limit | Monthly limit |

|---|---|---|---|

| Chip and PIN or mobile wallet like Apple Pay or Google Pay | Default: 2,500 GBP Maximum: 10,000 GBP | Default: 3,000 GBP Maximum: 10,000 GBP | Default: 10,000 GBP Maximum: 30,000 GBP |

| ATM withdrawal | Default: 1,000 GBP Maximum: 1,000 GBP | Default: 1,500 GBP Maximum: 1,500 GBP | Default: 3,000 GBP Maximum: 4,000 GBP |

| Contactless | Default: 500 GBP Maximum: 500 GBP | Default: 500 GBP Maximum: 1,000 GBP | Default: 3,000 GBP Maximum: 4,000 GBP |

| Magnetic stripe | Default: 300 GBP Maximum: 1,200 GBP | Default: 400 GBP Maximum: 1,200 GBP | Default: 1,200 GBP Maximum: 6,000 GBP |

| Online purchase | Default: 1,000 GBP Maximum: 10,000 GBP | Default: 1,000 GBP Maximum: 10,000 GBP | Default: 2,000 GBP Maximum: 30,000 GBP |

It’s good to know that Wise personal debit cards work a little differently to Wise business debit cards in terms of the way the limits are applied. We’ll cover the Wise business debit card in more detail a little later.

Wise card fees

Here’s a rundown of all the Wise card fees you can expect to meet when ordering and using your Wise multi-currency debit card:

| Service | Wise debit card fee |

| One time card order fee | 5 GBP |

| Optional express delivery - get your physical card in 1 - 2 days | From 17 GBP |

| Digital card | Free |

| Order a new card | 3 GBP |

| Replace an expiring card | Free - Wise will remind you when you need a new card for convenience |

| Spend currencies you hold in your account | Free |

| Spend in currencies you don’t have in your account | Wise will auto convert the balance you have to the currency you need, using the mid-market exchange rate and the lowest available fees |

| First 2 ATM withdrawals a month, up to the value of 200 GBP | Free |

| Additional withdrawals, over the value of 200 GBP/month | 0.50 GBP per withdrawal + 1.75% of the withdrawal value |

Wise debit card exchange rate

Wise was created with a mission to make currency conversion cheaper and more transparent. Every time you switch currencies with Wise you’ll get the mid-market rate with no hidden markup - when you spend with your Wise debit card, convert currencies within your Wise account, or send an international payment.

This is different to banks and most other international card providers. Typically, the exchange rates you get from other providers will include a markup which is added onto the exchange rate used. That’s an extra fee, but it’s hard to spot and pushes up the prices you pay without you necessarily knowing it. To avoid this tricky fee, Wise uses the mid-market exchange rate and splits out the full costs of currency conversion for transparency. You’ll be able to see the full fees you pay when you switch currencies within your account - and if you use the card’s auto convert feature, you can be sure the transaction will be processed with the lowest fee possible.

How to get your debit card

Here’s how to get your Wise international debit card in just a few simple steps:

Open a Wise account online in just a few minutes

Top up your Wise account in the currency of your choice

Order your Wise card for a one time 5 GBP fee

Start spending with your digital card right away

Your physical card will arrive in the post in a few days - or you can choose express delivery for an extra fee to get your card in the shortest possible time

If you don’t already have a Wise multi-currency account it’s good to know you can register in just a few minutes using your email address, Facebook, Apple or Google ID.

You’ll also need to complete a verification step for security - this usually involves taking a selfie with your passport or other eligible ID document. Your account can be up and running as soon as it’s been verified - which is often instant, or at least within 24 hours of registering.

How to activate your Wise card

Once your physical card arrives in the post you’ll need to activate it. This is done simply by making a purchase using your PIN number - or if you’d prefer you can make a cash withdrawal or check your balance in an ATM. You’ll be able to find your PIN, as well as your card number and CVV code, in the Wise app at any time.

How to top up your Wise card

Your Wise debit card is linked to your Wise multi-currency account. To add funds to your Wise account you’ll need to take the following steps:

Log into your Wise account online or in the Wise app

Select the currency balance you want to top up

Tap Add

Confirm the currency you want to pay with

Enter the amount you want to top up and select a payment method

Check everything over, confirm and follow the prompts to complete the payment

You can also add money to your Wise account directly from your online banking service using your local bank details for eligible currencies. In the UK, that means you can top up fee free in:

British pounds

Euros

US dollars

Australian dollars

New Zealand dollars

Singapore dollars

Canadian dollars

Romanian lei

Hungarian forint

Turkish lira

Log into your Wise account to see the local bank details for your preferred currency and use these to transfer money direct from your bank account in that currency.

Wise debit card for business

The Wise business debit card is currently available in the UK, EU and EEA, Canada, Singapore, Japan, Australia and New Zealand. If you’re in the UK you can expect your physical card to arrive 2 - 6 days after ordering it.

Wise business accounts come with multi-user access (MUA) which means you’ll be able to assign roles to your team members to let them access the tools they need to do their jobs, without needing to share sensitive company information. Anyone in your team assigned an employee or admin role within the Wise account will be eligible for a Wise business debit card, which they can use to spend and make cash withdrawals all around the world.

Like the Wise personal international debit card, the Wise business card offers currency exchange which uses the real mid-market exchange rate, and it’s always free to spend currencies you hold in your account. If you don’t have the currency you need, just allow the card’s auto convert feature to work its magic, and switch currencies from whichever balance incurs the lowest fee.

One important difference between the Wise business debit card and the Wise debit card for personal users, is the way spending limits work. You’ll be able to add multiple team members to your Wise business debit card, and each team member’s spending adds up towards the daily and monthly limits on the card. That means for example that if one team member makes a 1,500 GBP ATM withdrawal, no other withdrawals can be made from the account until the card resets at midnight. Team members will be able to see their own personal spending limits, and card holders with admin rights can see the total spending per transaction type across all issued cards.

Here are the limits you need to know about, for reference:

| Transaction type | Single transaction limit | Daily limit | Monthly limit |

|---|---|---|---|

| Chip and PIN or mobile wallet | 10,000 GBP | 10,000 GBP | 30,000 GBP |

| ATM withdrawal | 1,000 GBP | 1,500 GBP | 4,000 GBP |

| Contactless | 500 GBP | 1,000 GBP | 4,000 GBP |

| Magnetic stripe | 1,200 GBP | 1,200 GBP | 6,000 GBP |

| Online purchase | 10,000 GBP | 10,000 GBP | 30,000 GBP |

Where is the Wise card available?

If you have a Wise account and are a resident of any of the following countries and regions, you can apply for a Wise debit card:

The EU and EEA

The UK

British Overseas Territories and UK Crown Dependencies

Singapore

Malaysia

Japan

Australia

New Zealand

Brazil

Is Wise safe to use?

Yes. The Wise card is safe to use. As a company, regulated and covered by regulatory bodies all over the world. That means that no matter what currencies you hold on your Wise debit card, you know your money is kept safely and in accordance with global laws and best practices.

Wise accounts have a range of security features including thorough verification processes, 2 factor authentication and a 24/7 fraud prevention protocol. Additionally, Wise debit cards can be frozen instantly in the Wise app if you’re concerned about security, with real time transaction notifications and the option to check your balance and account history in a glance in the app.

Conclusion: is the Wise card worth it?

The Wise debit card can make life easier - and help you save money - if you travel often, shop with international ecommerce stores, or have a business and want to issue your team with international debit cards to manage spending.

Wise currency exchange always uses the real mid-market exchange rate with no markup and no hidden fees - and with the Wise debit card’s smart auto convert feature you don’t even need to switch currencies before you travel. Leave the Wise card to switch to the currencies you need, when you need them, with the lowest possible fee every time.

At up to 88% cheaper than using debit cards issued by traditional UK banks, and with no ongoing card or account costs, there’s really not much of a downside.

FAQs

Can I use my Wise card abroad?

Yes. Infact, the Wise card can help you cut the costs of currency conversion when you spend and make withdrawals in over 200 countries around the world.

Is the Wise card contactless?

Yes. The Wise international debit card is contactless for convenient spending.

General advice: The information on this site is of a general nature only. It does not take your specific needs or circumstances into consideration. You should look at your own personal situation and requirements before making any financial decisions. We compare currency exchange and money transfer services in over 200 countries and territories worldwide. We only display reputable companies which we have researched and approved.