Wise Review 2026: Features, Pros & Cons

Wise (formerly TransferWise) is a global technology company focused on building the best way to move money around the world. Launched in 2011, Wise now has over 16 million customers and is moving over £60 billion annually.

This Wise review covers all you need to know about Wise, including fees, whether it's safe to use, how fast it is, how to get set up, and more.

Wise review: Key points

Key features:

Services: International money transfers, and multi-currency account and card services for individuals and businesses

Price: All currency conversion uses the mid-market exchange rate with no markups and low, transparent fees

- Speed: Wise uses its own payment network - a different approach to traditional banks - to cut costs and move money faster. 50% of transfers from instant, 90% are delivered within 24 hours

- Scope: Banks like Monzo and N26 use Wise as well as Enterprise customers like Google Pay and Xero

Key stats:

- 16 million customers, moving £5.5 billion internationally every month

- Send payments to 160+ countries, spend with your Wise debit card in 150 countries

- The Wise account is available in 150+ countries

- Get local bank details for 9 currencies to get paid to your Wise account for free from 30 countries

- Make international debit card withdrawals in 2.3 million ATMs globally

Pros:

Low and transparent fees, with the mid-market exchange rate

50% of transfers are instant, 90% are delivered within 24 hours

Fully regulated and authorised by the appropriate regulatory authorities everywhere it operates. A publicly listed company on the LSE.

Access your account and make transactions online or in the Wise app for convenience

Personal, business and enterprise level services available

Cons

- Payments arranged online and in-app only - no cash or cheque transfer options

- Fees and limits do apply, and can vary based on the destination country

- No branch network - all customer service is online and by phone

Overall:

Wise has built its own payment network that has made it significantly faster and cheaper to send money abroad. On top of that, they are also completely transparent, showing you the total cost of your transfer and using the mid-market exchange rate. They've also expanded their offering to a multi-currency account, which makes it easy for people and businesses to send, spend, receive and hold multiple currencies.

How much can I save with Wise compared to a bank?

Wise has built its entire business around offering low fees and the mid-market exchange rate for every payment.

Exactly how much you can save with Wise depends on where you're sending money to, the transfer value, and how you'll pay - we've looked at a few examples as a comparison below to help build a picture.

| Sending amount in GBP: | Barclays, the recipient gets: | Nationwide, the recipient gets: | Wise, the recipient gets: | Winner |

| 1,000 | 1,135.94 EUR | 1,121.66 EUR | 1,162.80 EUR | Wise |

| 5,000 | 5,680.20 EUR | 5,700.38 EUR | 5,815.44 EUR | Wise |

| 10,000 | 11,360.89 EUR | 11,424.13 EUR | 11,631.63 EUR | Wise |

Fees and exchange rates correct at time of research - 21st February 2024

The examples in the table assume you're sending a bank transfer from a GBP account to a recipient in the Eurozone. As you can see, in this comparison Wise typically offers a better value when compared to banks.

See how much you can save - and get more comparisons over on the Wise website or app.

What is a Wise Account?

Wise explains that its mission is to build the best way to move money around the world, by using new technologies and transparent charging structures. Best in this context means offering customers the cheapest, fastest, and most convenient way to make payments, through a secure and easy to use process.

Wise launched in 2011 as a money transfer service, but over time has added extra services into its portfolio. Wise now has three focus areas:

Wise money transfer

Wise international money transfers are fast, cheap and secure thanks to smart technological approaches which cut out many of the time consuming, and expensive intermediaries typically involved in cross border payments.

You can send money to 80 countries, and payments will be deposited directly into your recipient's bank account for ease.

There's no need for your recipient to have a Wise account themselves. Just create the payment on the Wise website or app, setting either the amount you want to send, or the amount you need the recipient to receive. You'll then instantly see the fees and exchange rates which apply.

Great for: anyone who needs to send money abroad direct to a recipient's bank account - one off and regular payments are all supported.

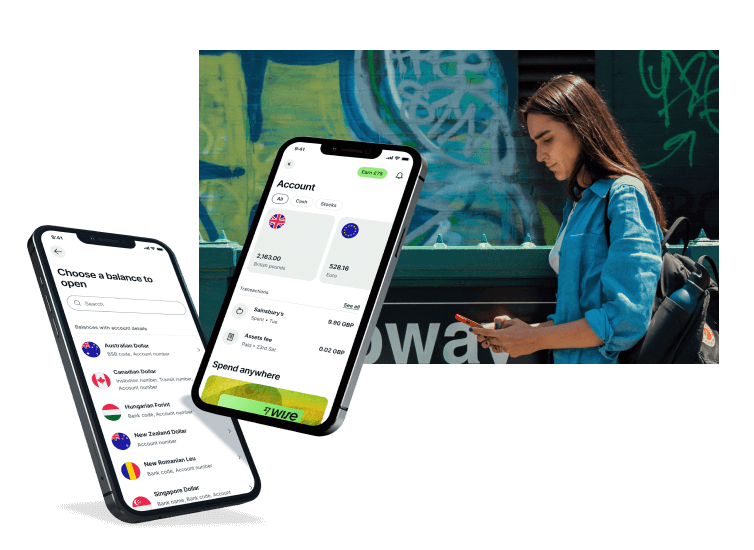

Wise account and card

What is Wise Account? With the Wise multi-currency account you can hold 54 currencies and send payments to 80 countries easily - you'll also get local account details in 10 currencies: GBP, EUR, USD, AUD, NZD, CAD, HUF, SGD, TRY and RON. That's perfect if you need to get paid in these currencies, as you can receive local transfers in any of these currencies, fee free.

You can open a free Wise multi-currency account online and get a linked debit card for easy spending and cash withdrawals around the world. Just top up your account in your preferred currency and then switch to the currency or currencies you need at the real exchange rate. Manage your account in the Wise app and you'll always be able to see all your available currency balances at a glance.

Great for: people and businesses sending and receiving frequent international payments.

Wise Business

In addition to the Wise money transfer services and multi-currency accounts, there are additional features and benefits for businesses and enterprise clients.

- Get local bank details in 10 currencies to get paid more easily by international clients

- Hold, send payments and switch between multiple currencies

- Pay international suppliers, contractors and team members more easily in their preferred currencies

- Make batch payments through a simple csv file upload, to cut admin time

- Add users to the account profile to let team members access functionality

- Autopate payouts with the smart Wise API

- Integrate with your favourite cloud based accounting software

Great for: businesses of all sizes, from freelancers/sole traders, to large corporates and enterprise level customers. Read more about Wise for business here.

How to make a money transfer with Wise?

Send a Wise money transfer to a bank account in any of the 80+ supported countries - or to another Wise Account in any of up to 10 currencies:

Log into your Wise Account online or in the Wise app

Tap Send on the app, or Send Money if you’re on the Wise desktop site

Enter the amount and currency you want to send - or the amount you want to recipient to get in the end

Confirm the transfer type - sending money for personal reasons or to a business for example

Follow the prompts to add your recipient’s details

Check everything over, confirm and your money is on the way

It’s good to know that you can send money with Wise by adding your recipient’s bank account information, but you can also make fast - or even instant - transfers using just their email.

Can I transfer money to an email address with Wise? Yes, you can. Just enter your recipient’s email, following the on screen prompts while you set up your payment. If your recipient already has a Wise Account, Wise can find their account details and deposit the payment there. And if they don’t have a Wise Account just yet, the system will generate an email asking the recipient for their banking information so they can easily get their money.

How to deposit money with Wise?

You can add money to your Wise Account easily, in a range of currencies depending on what you’d prefer. The easiest way to add money to Wise is to top up your preferred currency balance online or in the Wise app - here’s how:

Log into Wise and go to the balance you’d like to add money to

Click Add and enter the payment amount and currency

Select how you’d like to pay, and click Continue to payment

You’ll be guided through the payment steps via on screen prompts

Depending on the currency and how your Wise Account is set up you’ll usually be able to deposit money with Wise from your bank using a local transfer, or use a credit or debit card, or even Apple Pay. The fees for different deposit methods may vary, so keep an eye out for the on screen messages to help you decide which works best for your needs.

How does Wise (TransferWise) work?

Wise has built its own payment network which is cheaper and faster to operate compared to SWIFT - the system used by traditional banks to send international transfers. That means better prices and faster transfers.

The way Wise works is actually surprisingly simple. Instead of moving money across borders through complex payment networks, Wise has its own network of accounts in all the countries it operates in. When you make a payment in pounds you send it in GBP to the Wise account in the UK. Wise then transfer the equivalent amount from their account in the destination country, in the currency you need. That means no money really has to cross borders, cutting the costs and the time involved.

Regular banks on the other hand typically use the SWIFT network - a network of partner banks which pass payments between themselves until they reach the correct destination account. SWIFT is established and reliable - but also expensive and slow. Each bank involved in the payment chain can add an intermediary fee which is tricky to predict and pushes up prices.

With Wise, because there are no intermediaries, there are also no surprise costs - allowing a more transparent payment structure.

Who is Wise good for?

The Wise Account can be opened by individuals, freelancers, entrepreneurs and business owners in the UK and in a broad range of other countries around the world.

Because Wise has no ongoing account fees, no minimum balance and a flexible range of supported currencies and services, it can be good for a broad range of customers, including:

Anyone who likes to travel and wants to spend and withdraw cash with low fees internationally

Individuals who need to pay bills overseas or remit money to loved ones at home

Online shoppers who love ecommerce sites based abroad

Freelancers who need to get paid by customers and clients internationally

Business owners paying suppliers, contractors and staff in foreign currencies

Anyone who wants to hold and exchange 50+ currencies with the real exchange rate, and manage their money right from their phone or laptop

Is Wise safe?

Yes, Wise (TransferWise) is safe and trustworthy. Wise is regulated by the appropriate financial regulatory bodies in all the countries it operates in. Wise transfers are made using leading edge technology, and with a dedicated anti-fraud team on hand to ensure money is kept safe. Here are some key facts about Wise safety and security:

- Customer funds are safeguarded using leading financial institutions

- Wise is regularly audited to check everything is working smoothly

- Advanced data protection and 2-step authentication processes are used

- Round the clock fraud prevention systems including both technology and a dedicated team

- Wise is a publicly listed company, with some 16+ million customers and 2,800 employees - and is trusted by 17 banks and 300,000 business and enterprise customers

Wise (TransferWise) fees

Wise has disrupted the international payment market by challenging banks and established providers on fees. Wise fees and pricing are transparent, which you can learn about here. In short, Wise aims to:

- be radically transparent

- charge as little as possible

- make premium the new normal

- lower fees over time

There are also discounts available that automatically apply to your account if you're sending higher amounts - more on that coming up later. Here's the lowdown on how Wise fees work.

Wise money transfer fees

Wise fees can be split into 2 costs:

Fixed fee: covering the fixed costs associated with the transaction. For major currencies this can be in the region of £0.20 - £0.28

Variable fee: covering the cost of the currency exchange. For major currencies this can be in the region of 0.43% to 0.47% of the transfer value

You'll always see the fee upfront before you make your payment. Here are some cost examples for sending 1,000 GBP to some popular major currencies:

| Sending GBP to: | Fixed fee | Variable fee | Total fee |

| AUD | 0.27 GBP | 4.08 GBP (0.41%) | 4.35 GBP |

| BRL | 0.27 GBP | 11.03 GBP (1.11%) | 11.30 GBP |

| CAD | 0.34 GBP | 4.68 GBP (0.47%) | 5.02 GBP |

| CHF | 0.34 GBP | 4.48 GBP (0.45%) | 4.82 GBP |

| EUR | 0.21 GBP | 4.28 GBP (0.43%) | 4.49 GBP |

| INR | 0.28 GBP | 5.48 GBP (0.55%) | 5.76 GBP |

| JPY | 1.30 GBP | 4.87 GBP (0.49%) | 6.17 GBP |

| USD | 0.26 GBP | 4.38 GBP (0.44%) | 4.64 GBP |

Wise exchange rate

Wise uses the mid-market exchange rate - that's the one you'll find on a currency converter tool or with a Google search - without any hidden fees.

That's different to many banks or international payment providers, which add extra costs into the exchange rates they offer in the form of a markup. These fees can be tricky to spot, so customers end up paying more than they need to without ever realising it.

Wise multi currency account and debit card fees

There's a full rundown of the Wise international account and card fees here. Let's look at the key details:

| Service/fee type | Wise multi-currency account fee |

|---|---|

| Open account | Free |

| Get local details for 10+ currencies | Free |

| Hold 50+ currencies | Free |

| Get a Wise debit card | 5 GBP for first card, 3 GBP for subsequent replacements |

| Spend with your Wise card | Free |

| ATM withdrawals | First 2 withdrawals/month, the the value of 200 GBP are free. 1.75% + 0.50 GBP per withdrawal fee after that |

| Convert currencies within your account | Low fees and the mid-market exchange rate |

| Send payments to other currencies from your account | Low fees and the mid-market exchange rate |

| Receive payments to your account |

|

Sending large amounts with Wise

Wise can be used safely for high value payments, too.

The variable fee applied to international payments with Wise gets cheaper for higher value transfers. Discounts are automatically applied to qualifying accounts - there's no need to get in touch with Wise to make arrangements. That means you could instantly get even better value when sending high value transfers - usually over around £100,000.

The default limit for transfers is £1 million, but higher limits can be arranged on request. You may need to provide more information about the payment to comply with financial service rules - but the Wise team can guide you through that if it's needed.

For example, if you're making a transfer to move the funds from a property sale or inheritance you may be asked to show a bank account statement to show the money being deposited to your account and documents to verify the source of the funds.

Learn more about high value transfers with Wise here.

How long does Wise take

The good news is that 40% of Wise's international transfers are instant (delivered in less than 20 seconds), while 80% are delivered within 24 hours.

The exact length of time it'll take for your Wise payment to land can vary based on the destination country and currency, and how you're paying. But you'll aways see an estimated delivery time when you set up your payment so you know what to expect, and you'll be able to track your transfer in the app if you need to.

Wise Pros

- Mid-market exchange rate currency conversion

- Low, transparent fees for transfers and account services

- Online and in-app services for ease

- Multi-currency account and card services

- Fast and secure transfers to 80 countries

- Business and enterprise level services available

Wise Cons

- No cash or cheque transfer options

- Fees and limits apply, and can vary based on the destination country

- Account verification requirements are in place

- No branch network

How to use Wise

You can use Wise easily in the UK, to send, spend, hold, receive and exchange money.

Because Wise has no ongoing account fees, no minimum balance and a flexible range of supported currencies and services, it can be good for a broad range of customers, including:

- Log into your account

- Type in how much you want to transfer, or how much you need the recipient to get

- Confirm the type of payment

- Enter the recipient's details - bank account number or email

- Check over the details

- Add a reference or message for your recipient

- Fund your payment using a card or bank transfer

- Confirm and your money will be on the move

Get a full guide to sending money with Wise here.

How to send money with Wise

Using Wise is easy. All you need is your smartphone or computer. Here's what to do:

Log into your account

Type in how much you want to transfer, or how much you need the recipient to get

Confirm the type of payment

Enter the recipient's details - bank account number or email. The exact information required will depend on the destination

Check over the details

Add a reference or message for your recipient

Fund your payment using a card or bank transfer

Confirm and your money will be on the move

Get a full guide to sending money with Wise here.

Funding methods

You'll be shown the available funding methods for your specific transfer when you set up the payment. Usually these are:

- Bank transfer

- Credit or debit card

- Apple Pay

Funding your Wise international payment by bank transfer is the most popular method and usually least expensive.

Payout methods

Wise payments usually arrive directly in the recipient's bank account. However, Wise does support other payout methods on some payment routes. You'll see your options when you set up your payment.

How to open a Wise account

Creating a Wise account is easy, and can be done entirely online.

- Register with your email address, or an Apple, Google or FaceBook account

- Follow the prompts to enter your personal details

- Upload your ID documents for verification

- Once your account is verified you can start sending payments

There's a full guide to getting verified with Wise here.

What documents you'll need

The exact documents you need will depend on the type of account you want, and the type of payments you're making. You'll be guided through the process, and can always get in touch with Wise customer support if you need help. If you need to stop while verifying your account you can simply save and exit the process and come back to it later.

Usually for a personal account you'll need:

- A valid ID document like a passport or driving license

- A proof of address like a utility bill or bank statement in your name

For a business account you'll need:

- ID and address documents for the account owner

- Information about the business including address, industry and registration number

- Names, date of birth, and country of residence for directors and shareholders who own 25% or more of the business

There's a full guide to getting your business account verified with Wise.

How long does verification take with Wise?

Verification may be done instantly - this is often the case if you're sending a relatively low value payment from a bank account in your own name. If you need to upload additional documents verification can still be done on the same day in some cases - or certainly within a couple of working days.

Wise account limits

Wise payment limits are set by currency. Usually you'll be able to send high value payments as an individual of up to 1 million GBP or the currency equivalent.

Check the details for Wise limits for your currency here.

Supported currencies

Wise supports 50 different currencies and lets you send to over 80 different countries.

Wise regularly updates the countries and currencies available for payments - for the latest info check here.

Wise (TransferWise) reviews

Trustpilot is a great resource for checking out reviews of businesses you may want to deal with. See what previous customers have said before you get started, so you'll know you're going to get a good service.

At the time of writing, Wise has an Excellent score on Trustpilot, of 4.2 stars out of 5. Happy customers touch on the great rates offered:

"I have used Wise many times and they have never disappointed, fast transfers and great rates, I would highly recommend."

And the peace of mind which comes from a fast and reliable service:

"peace of mind, fast, efficient , reliable. Very pleased with WISE services."

Of course, not all Wise reviews were as glowing. At the time of writing, 1% of respondents gave Wise a Poor review, and 5% gave a Bad review.

Recent poor customer reviews tended to reflect accounts which have been frozen while verification and terms of use checks are carried out. On the positive side, Wise customer service responses within Trustpilot are up to date and suggest that Wise agents are able to understand and manage issues which are flagged through this route.

Is Wise a bank?

Wise is a financial technology service, not a bank. Wise uses similar fraud detection tools and security technologies to banks. Customer funds are safeguarded - that means they're held securely in Wise's partner banks, separate from Wise's own company funds.

Wise accessibility

You can use Wise from your desktop, or get the app with an Apple or Android device. Wise has customer support in a range of languages, and a handy FAQ section online where you can get answers and troubleshooting support for common problems.

Wise (TransferWise) customer service

Generally, Wise is easy to use and offers a simple self service customer experience, meaning you can easily transact without needing to speak to someone. However, help is on hand if things go wrong.

The easiest way to get personal support from Wise is to log into your account and use the in-app and online chat feature. You can also use email and social media channels.

| Contact channel | Wise availability |

|---|---|

| Personal chat support | Log into your account online or in-app |

| Phone support | Log in and visit the Wise help page to get the best phone number for your account type and query |

| You can also log into your account to message Wise support about specific payments more easily - just click on the payment you'd like to query to get support options |

Wise alternatives

It makes sense to check out some alternative providers before you start making payments or open an account. The alternative which suits you could vary depending on the type of transactions you want to make. Here are a few to consider.

We'll dive into the detail on one of them - in just a moment:

- Western Union

- domestic and international payments arranged online or in person via an agent, payouts to bank accounts or for cash collection. Western Union does support more countries compared to Wise, but the overall costs for online payments tend to be higher.

- PayPal or Xoom - send instant payments at home and abroad. Overall costs tend to be higher compared to using Wise, and if you choose PayPal your recipient will also need to set up a PayPal account to get their money.

- Revolut - open an online international account to send and hold multiple currencies from the same account. Revolut accounts have handy features like savings vaults and budgeting features, and junior accounts can be set up for kids - but you'll need to upgrade to a fee paid account to access some of the features on offer.

Wise vs Revolut

If you're looking for smart, simple ways to send international payments you may have also come across Revolut. Let's see how the features of both Wise and Revolut measure up side by side:

| Wise features | Revolut features |

| Fast online money transfers direct to your recipient's bank account | Fast online money transfers direct to your recipient's bank account |

| Set up exchange rate alerts and target rates to transfer when the time is right for you | 5 tiers of multi-currency account, including the Standard plan which has no monthly fee |

| Free multi-currency accounts to hold 40+ currencies | Hold and exchange 28+ fiat currencies plus crypto |

| Transfers use the mid-market exchange rate without a markup | Linked Revolut card for easy spending |

| Send money to 160+ countries | Spend in 150 countries |

| Spend with your Wise Mastercard in 150 countries | Open Revolut <18 accounts for kids |

| Get local receiving accounts for 30+ countries | Earn interest on savings - level varies by account package |

| Secure, fully regulated payment service | Secure, fully regulated payment service |

| Website, app and support in 14 languages | Service currently available in countries and regions including Europe, the US, Australia, Japan and Singapore |

And if you're still not sure about the benefits and drawbacks of each, here are some pros and cons to consider, too:

| Wise pros | Revolut pros |

| Low, transparent fees | Selection of account plans available |

| Transfers to 160+ currencies | <18 accounts for younger family members |

| All personal accounts are free to open, with no service fee | Some no fee transactions available - details vary according to account plan |

| Local receiving accounts to get paid from 30 countries for free | Earn interest on savings |

| Wise cons | Revolut cons |

| Online and mobile service only | More expensive during weekends |

| Transfer fees vary by destination and payment method | Accounts are not available globally |

| International transfers can't be made in cash, or for cash collection | To get the full range of features you'll need to pay a monthly fee |

| Not all currency balances earn interest | Accounts can hold and manage only around 28 currencies - check the ones you need are available |

Conclusion

Wise is great for people looking for low cost, fast international payments, and smart ways to manage their money across currencies. Because Wise currency conversion uses the mid-market exchange rate without hidden fees - and a low, transparent charging structure - services tend to be cheaper compared to competitors, with no nasty lurking surprises. Click the button below to go to Wise, or read about our exclusive Wise promo code for Exiap readers.

Wise review FAQ

Can you use Wise in the UK?

Yes. Wise is available in the UK for personal and business customers.

How much does Wise cost?

Wise transfers have low transparent fees and use the mid-market exchange rate with no markup.

How long does Wise take to transfer funds?

Many Wise payments are instant, 90% arrive within 24 hours.

Is Wise safe?

Yes, Wise is a safe and trustworthy company. It's regulated by appropriate regulatory bodies in all the countries it operates in.

How does Wise apply exchange rates?

Wise used the mid-market exchange rate with no markups or extra fees added.

Does Wise have a mobile app?

Yes. Get the Wise app for both Android and Apple phones.

How does Wise work?

Wise international transfers are arranged online and in-app, and deposited directly into recipient bank accounts. Because transfers are processed through Wise’s own payment network, the fees can be lower than with other providers.

How many currencies does Wise support?

Hold 40 currencies in a Wise account and send payments to 160 countries.

Is Wise good for money transfer?

Wise offers money transfers to 160+ countries which use the mid-market rate and low fees from 0.42%. In our comparisons it was a good option compared to UK banks, with cheaper and more transparent fees.

Is the Wise exchange rate good?

Whenever you exchange currencies with Wise you get the mid-market exchange rate. That’s the rate you’ll find on Google or when you use a currency converter tool, and a good rate according to our comparisons.

General advice: The information on this site is of a general nature only. It does not take your specific needs or circumstances into consideration. You should look at your own personal situation and requirements before making any financial decisions. We compare currency exchange and money transfer services in over 200 countries and territories worldwide. We only display reputable companies which we have researched and approved.