6 Cheap and Safe Ways to Pay International Invoices in 2026

Do you have to pay overseas invoices? Paying international invoices business, or as a personal customer for things like school fees, medical expenses, or utility bills can be difficult, time-consuming, and expensive. Sometimes it can even be risky. But it doesn't have to be.

In this article, we will look at 6 methods that offer safe, cheap, and fast ways to pay international invoices. We'll explore their pros and cons, and when they can be a good option.

Key takeaways: Paying foreign invoices

The best way to pay an international invoice ultimately depends on the payment terms set by the vendor

There are several ways to pay international invoices, which can include bank transfers, online payment providers, credit card payments, and multi currency business accounts from providers like Wise and Revolut

Each method has tradeoffs in terms of fees, exchange rates and speed - this guide will help you compare your options

Providers like Wise, Revolut and OFX can be convenient and cost-efficient solutions for paying international invoices

Wise and Revolut also offer international business account services. With Wise, you get the mid-market exchange rate for USD, EUR and 40+ other currencies with low fees, while Revolut supports 25+ currencies and offers different account tiers to help you manage your spending more easily

What's the safest way to pay an international invoice?

Sending money overseas can seem risky, but if you pick a reputable and well liked service, you should find it's safe with normal common sense precautions. Here are a few of the steps taken by the providers we look at in this guide, to ensure your money is kept safe:

OFX: Secure account log in and 24/7 phone support if you ever need it

Wise: 2 factor authentication, easy in app chat for help and industry level anti fraud measures

Revolut: Thorough account verification with automatic and manual anti fraud tools to keep accounts secure

Remitly: Offers guidance on avoiding scams, as well as high level in-built security

Xe money transfer: Part of a very large money transfer group, which has industry leading security measures in place throughout the process

PayPal: Secure account log in and verification, easy ways to get support if needed

Western Union: Branch service if you need face to face help, with secure digital payment and support offered

Using credit cards: Credit card providers often have some fraud protections which are offered by law, and as a perk to their customers

How to pay international invoices: 6 ways

In this article, we'll cover:

| Methods | Great for: |

|---|---|

| International money transfer | Higher value payments to recipients who prefer to have their money sent directly to their bank, and who don't pay international receiving fees |

| Wise | Low cost transfers - including high value transfers - which can be deposited to banks in 140+ countries quickly or even instantly |

| Use an international business account | International business accounts from specialist providers can offer flexible ways to send and receive payments in select global currencies |

| PayPal | Quick deposits to PayPal accounts globally, when your recipient doesn't have a bank account or uses PayPal as their primary business account |

| Paying with a credit card | Spreading the costs of your invoice across a few months, or for convenience when your invoice includes a card payment link |

| Western Union | Sending money for cash collection more or less anywhere in the world – often within minutes |

1. International money transfer online

International money transfers are transfers made directly into a recipient's bank account. This is the traditional way of paying for overseas bills and can be done through banks like Barclays or Lloyds, or specialist money transfer providers like Wise, OFX and WorldRemit.

| Provider: | International transfer fees | Exchange rates | Transfer limits | Transfer speed |

|---|---|---|---|---|

| OFX | No fee | Exchange rates may include a markup | Usually no limit | 1 - 2 days |

| Wise | Variable fee from 0.33% | Mid-market rate | Varied by currency, usually around 1 million GBP per transfer | More than 60% of transfers are instant, vast majority arrive within 24 hours. |

| Remitly | Variable fee based on country and currency | Exchange rates may include a markup | 25,000 GBP per transfer | Variable delivery time, depending on country and receive method |

| Xe money transfer | Variable fee based on country and currency | Exchange rates may include a markup | 375,000 GBP per day | Variable delivery time, depending on country |

| Barclays Bank | 15 GBP for digital transfer, 25 GBP in branch | Exchange rates may include a markup | 100,000 GBP per day | Variable delivery time, depending on country |

| Lloyds Bank | 15 GBP for digital transfer, up to 28 GBP in branch | Exchange rates may include a markup | 250,000 GBP per day online - higher payments may be available in branch | Variable delivery time, depending on country |

*Details correct at time of research - 28th April 2025

When is this a good option?

An international money transfer is a good option if:

The issuer of the invoice has an eligible bank account you can pay into

The person you're paying won't get charged high recipient fees by their own bank

The invoice is fairly large – some banks and money transfer providers only allow bill payments over a certain amount

You have a unique reference such as an invoice number which you can include as a message on the transfer so your payment can be identified easily

Pros and cons of paying a bill via an international money transfer

| International money transfer pros | International money transfer cons |

|---|---|

✅ Exchange rates used for international money transfers are often more favorable than using credit or debit cards. ✅ Transfers via banks and specialist providers are generally safe and secure. ✅ You can complete the transfer at a branch if you need more assistance. ✅ You can easily setup a transfer online with specialist money transfer providers, and with some banks. ✅ Alternative providers like OFX, Wise, and Remitly may be faster and cheaper | ❌ You usually need an account with the bank to make an international money transfer. ❌ Banks may have high transfer fees. Can be expensive for sending small amounts. ❌ Some providers may include a markup on the exchange rate, making the overall cost higher. |

How to pay an international invoice with an international money transfer

Log into your online or mobile banking service

Navigate to the payment section and select international transfers

Enter the amount and currency you need to send

Add your recipient's details and your payment reference

Confirm your transfer

Best international money transfer apps to pay invoices

There are many alternatives to banks and money transfer services. International money transfer apps like OFX, Wise, and WorldRemit might be faster and cheaper than banks.

The best international money transfer app for you will depend on your needs, you can compare providers and choose the best one for yourself.

OFX: Send money to more than 150 countries in more than 50 currencies. OFX offers various money management tools, including risk management.

Wise: Fast, convenient, low-cost payments to more than 140 countries in more than 40 currencies. Wise uses the mid-market exchange rate and has a transparent fee structure.

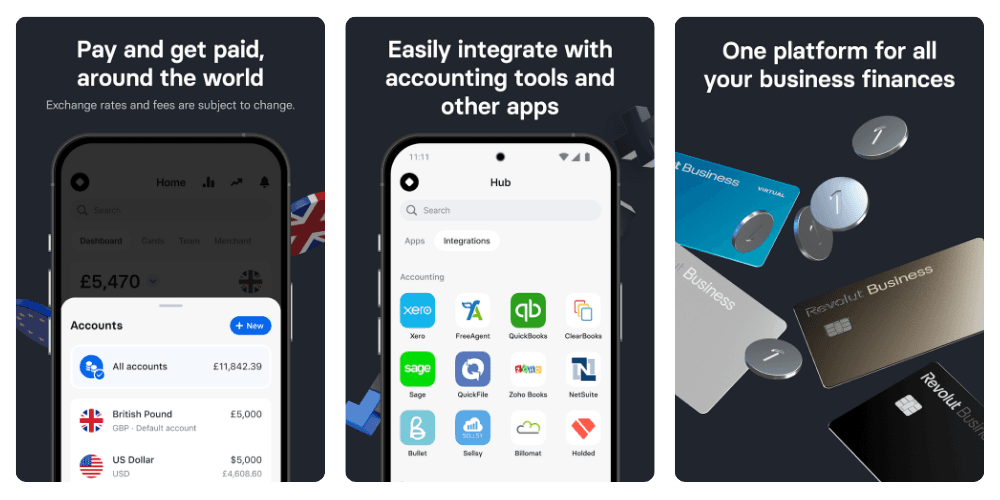

Revolut: Pay bills in more than 25 currencies. Tiered account options offer various services. Revolut provides analytics tools to monitor spending.

WorldRemit: Send money to more than 130 countries via the WorldRemit mobile app. An account can be funded using popular credit and debit cards, as well as ApplePay. WorldRemit offers 24/7 support in 6 different languages.

Remitly: Transfer to more than 100 countries worldwide. Remitly offers low transfer fees and a great range of pay in and pay out methods. A cash pickup option is available in some countries.

2. Wise

Wise is a specialist in personal and business account services, and an international money transfer provider that offers low, transparent fees, mid-market exchange rates, and fast transfers. With Wise Business, you can pay invoices and make recurring payments to more than 140 countries in more than 40 currencies.

You can also get debit and expense cards for you and your team, and receive money in foreign currencies conveniently. Wise Business customers get extra perks including cloud accounting integrations, multi-user access, and a powerful API to streamline workflow.

Launched in 2011 in the UK, Wise has more than 12 million active customers worldwide supporting money transfers quickly, cheaply, and safely.

| Provider: | Coverage | International transfer fees | Exchange rates | Transfer limits | Transfer speed |

|---|---|---|---|---|---|

| Wise | Send to more than 140 countries in more than 40 currencies | From 0.33% | Mid-market rates | Varied by currency, usually around 1 million GBP per transfer | More than 60% of transfers are instant, vast majority arrive within 24 hours. |

*Details correct at time of research - 28th April 2025

When is this a good option?

Wise is a good option if:

You need a fast, convenient, and low-cost way to pay invoices

You prefer to manage your money online or by app

You need one-off, recurring, or even payouts to up to 1,000 people at one

You're sending anything from under a pound up to about 1 million pounds, as Wise limits are high for convenient business payments

Pros and Cons of using Wise for international money transfer

| Wise pros | Wise cons |

|---|---|

✅ Transparent fees mean you always know what you are paying ✅ More than 60% of transfers are instant, vast majority arrive within 24 hours ✅ Uses the mid-market exchange rate for currency conversion ✅ You can pay large or small invoices ✅ Sent to more than 140 countries in more than 40 currencies | ❌ Wise is not a bank so it doesn't have branches ❌ Fees can vary between countries and currency routes ❌ No cash deposits |

How to pay an international invoice with Wise

Log into your Wise account online or in the app

Tap Send Money

Enter the amount you need the recipient to get, and the currency

Choose your payment method and add your recipient details – if you've sent money to this recipient before you can just pick them from your recipient list

Pay and your money is on the way

Learn more - How to open a Wise Business account in the UK, and Wise Business Account Review

3. Use an international business account

These days, most banking can be done online so it can make sense to set up an international business account you can manage digitally, which supports foreign currencies for sending and receiving. There are various different options, including some very comprehensive international business accounts from specialist providers which have been optimised for sending payments overseas, holding foreign currencies, and receiving money conveniently.

Once the account is open, you can simply receive payments to your international business accounts - or add money to the account yourself - and then use it to pay bills as they arise.

The Wise Business account offers local or SWIFT account details in 20 currencies including Euro, USD, CAD, and GBP. Also, it allows you to hold and exchange 40+ currencies.

Revolut has various accounts with different monthly fees, ranging from 0 GBP to 45 GBP per month for personal customers, and 10 GBP to 90 GBP for a business customer. You can hold more than 25 currencies.

| Provider: | Coverage | Account fees | Transfer fees and exchange rates | Transfer limits | Transfer speed |

|---|---|---|---|---|---|

| Wise Business Account | Send to more than 140 countries in more than 40 currencies | One time account opening fee of 50 GBP | Transfer from 0.33% Mid-market rates | Varied by currency, usually around 1 million GBP per transfer | More than 60% of transfers are instant, vast majority arrive within 24 hours. |

| Revolut Business Account | Send to 150+ countries | Monthly fee of 10 GBP to 90 GBP depending on plan | 5 GBP per transfer, some account tiers have a set number of no fee transfers Weekday exchange with the Revolut rate to plan limit, then a fee of 0.6% begins. Additional fee of 1% for weekend conversion | Variable limits based on currency | Variable delivery times based on the country and currency involved |

*Details correct at time of research - 28th April 2025

When is this a good option?

Setting up an international business account is a good option if:

You regularly pay several bills in the same country

You've found an account you like which has an account you're eligible to apply for

You need to pay foreign contractors or freelancers on a regular basis

Pros and cons of setting up an international business account

| International business account pros | International business account cons |

|---|---|

✅ Flexible accounts which support multiple currencies ✅ Card services are usually also available ✅ You can set up an account online with providers like Wise and Revolut ✅ Business perks offered, like batch payments ✅ Recurring bill payments are easy to set up | ❌ Some accounts have ongoing fees ❌ Not all services available from banks will be offered ❌ Transaction fees are likely to apply |

How to pay an international invoice with a local bank account

Log into your international business account and select transfers

Add money to your account if there isn't enough in the balance already

Enter the amount your recipient should receive in the local currency

Add your recipient's information

Initiate the transfer

4. PayPal

PayPal is one of the world's largest internet payment companies. It is easy to set up an account and most overseas billers will accept payment from PayPal, making this very convenient.

| Provider: | Coverage | International transfer fees | Exchange rates | Transfer limits | Transfer speed |

|---|---|---|---|---|---|

| PayPal for business | 25+ currencies supported | 2% of sent amount to maximum caps set by currency - for example 70 EUR or 100 AUD | 3% above base rate. Check today's PayPal exchange rate. | Check your specific limits in the PayPal app | Variable delivery times depending on the details of the payment |

*Details correct at time of research - 28th April 2025

When is this a good option?

PayPal is great to pay bills if:

You already have a PayPal account

Your recipient prefers PayPal to a direct bank deposit

You use PayPal frequently for your own business transactions

Pros and cons of paying a bill by PayPal

| PayPal pros | PayPal cons |

|---|---|

✅ Paying bills with PayPal is quick and easy, especially if you already have a PayPal account ✅ Pay multiple people at once ✅ 25+ currencies supported for payments ✅ Costs of transfers are capped depending on the currency sent ✅ Globally known and trusted provider | ❌ Not all billers can be paid via PayPal ❌ PayPal's fee structure can be complicated ❌ PayPal is not a bank so it doesn't have branches |

How to pay an international invoice with PayPal

Log into your PayPal account online or in the app

Select Send money

Enter the amount and currency to send

Add your recipient's email address, which is linked to their PayPal account

Check everything over and confirm

5. Paying by credit card

Many people pay overseas bills with their credit cards. This can be costly as banks and card issuers may charge a percentage fee on the transaction amount. However, there is usually no added flat fee for credit card bill payments.

| Coverage | Transfer fees & exchange rates | Transfer limits | Transfer speed | |

|---|---|---|---|---|

| Paying foreign bills by credit card | Usually global outside of specific sanctioned countries | Interest may apply if you don't repay your bill in full Cash advance fees may apply Provider exchange rates will apply, often with a foreign transaction fee of about 3% | Limits are likely to be based on your card's credit limit | Usually instant |

*Details correct at time of research - 28th April 2025

When is this a good option?

Using a credit card to pay bills can be a good option if:

You need to spread your costs over a few months and don't mind paying a fee to do so

You're making small international bill payments

You don't want the hassle of setting up international money transfers.

Pros and cons of paying a bill by credit card

| Credit card pros | Credit card cons |

|---|---|

✅ Credit cards are widely accepted as payment methods ✅ Convenient for paying smaller bills ✅ You may accrue rewards or air miles as you spend, depending on your card ✅ With responsible use you can build a good credit score ✅ Banks and credit card companies usually provide some form of fraud protection | ❌ High costs can apply if you don't repay your bills monthly ❌ Exchange rates may not always be favorable ❌ Providing your credit card details to an unknown vendor may be risky. |

How to pay an international invoice with a credit card

If your invoice includes a card payment link, click it and follow the instructions

If not:

Log into your credit card account and find the transfer option

Enter the amount to send to your recipient and the currency it should be deposited in

Add your recipient's account information

Confirm the transfer

6. Western Union

Western Union has more than 500,000 agents worldwide, providing various services like international money transfers to almost every country in the world. It is a popular choice for cash pickup transfers.

| Provider: | Coverage | International transfer fees | Exchange rates | Transfer limits | Transfer speed |

|---|---|---|---|---|---|

| Western Union for business payments | Send to almost every country in the world | Variable fees depending on the transfer details | Exchange rates may include a markup | Variable limits depending on the transfer details | Cash transfers can be very fast, bank deposits may take a few days |

*Details correct at time of research - 28th April 2025

When is this a good option?

Western Union can be a good option if:

The recipient doesn't have a bank account

The recipient would prefer to be paid in cash they can collect almost instantly

You're sending in a very unusual currency – Western Union supports payments to almost every country in the world

Alternative providers like WorldRemit and Remitly also offer cash pickup options. Learn more about Western Union alternatives in the UK.

Pros and cons of paying a bill via Western Union

| Western Union pros | Western Union cons |

|---|---|

✅ Western Union has a wide global reach ✅ The recipient doesn't need to have a bank account ✅ Send cash via one of their 500,000 agents ✅ Most global currencies are supported ✅ Western Union is a well-known and trusted service | ❌ Western Union has fees which include a markup on the exchange rate ❌ Pay out options vary widely between countries ❌Transfers can take up to 4 business days to arrive

|

How to pay an international invoice with Western Union

Log into your Western Union account

Select send money and enter the amount and currency

Pick how you want to pay, and how the money should be received

Fund the transfer and it'll be on the way – if you're sending for cash collection you'll need to pass a payment reference to the recipient so they can get their cash.

How to pay international invoices

The steps to pay international invoices may differ depending on which method or provider you choose.

Keep in mind that some international payment methods can have lower costs, but longer delivery times, while others may have short delivery times, but at higher costs. Consider this when choosing a provider, then follow the steps to set up an international bill payment or pay a foreign contractor.

While the steps to pay international invoices may vary between providers, they usually involve some of the following steps:

Create and verify an account

Fund the account by depositing money or linking a bank account or credit or debit card

Provide details of the provider or choose from a list

Choose the currency route

Review and compare fees to choose the best option

Submit or send the payment

How to pay invoices in foreign currency

Paying an invoice in a foreign currency can be expensive due to the use of different exchange rates on the same currency, as well as exchange markups and fees. Banks and credit card issuers often charge premium exchange rate markups.

You may be able to save money by using online international money transfer specialists like Wise and OFX. These providers could offer faster transfers, at lower costs and at more favorable exchange rates than banks.

Providers like Revolut and Wise also offer multi-currency accounts that use local bank details in countries and regions including the UK, Europe, and North America. Multi-currency accounts help you to save on exchange fees since you are already paying in the local currency. These providers also offer multi-currency business accounts with various features to make international bill payments cheaper and easier:

Wise Business Account: Wise business account lets you pay invoices in more than 140 countries and get local or SWIFT account details in 20 currencies including Euro, USD, CAD, and GBP. Also, it allows you to hold and exchange 40+ currencies. Save money on overseas business expenses with the Wise Multi-Currency Card.

Revolut Business Account: Revolut offers several tiers of business accounts, which let you hold and exchange 25+ currencies and spend in 150 currencies. Connects with apps like Slack, Xero, and QuickBooks. Fees range from 10 GBP a month upwards.

What currency should I pay in?

Before you do anything with your international invoice, make sure you're clear what currency you should be paying in. You can agree the invoice currency upfront with your supplier before you complete the deal negotiations – which leaves less room for misunderstandings or hassle later.

Which currency is best is pretty subjective. Some suppliers, freelancers or contractors will want to be paid in their own home currency so the money can be deposited to their business bank account.

However, as GBP is a major global currency – and relatively stable – some recipients may prefer you to send in pounds, if they have a local GBP account at their end. They can then keep their money in GBP for future payments, as an investment, or as a hedge against currency fluctuation in future.

Here's how to pay invoices in a foreign currency

You can pay an invoice in a foreign currency by setting up an international money transfer and having the bank or provider convert your GBP to the currency needed. However, the easier - and often cheaper - option is to pay from a multi-currency business account like the Wise or Revolut Business accounts.

Here's an outline of what you'll need to do:

Log into your international business account and select transfers

Add money to your account if there isn't enough in the balance already

Enter the amount your recipient should receive in the local currency

Add your recipient's information

Initiate the transfer

Conclusion: What is the best way to pay international invoices?

There are several methods to pay international invoices. Each of these methods has its pros and cons, which one is best for you depends on your needs and requirements.

International money transfers with banks or paying with credit cards can be convenient to do, but they can often end up being costly. Western Union and WorldRemit can be good options if the recipient doesn't have a bank account, whereas PayPal can be fast if you already have a PayPal account.

Specialist international money transfer providers like Wise and OFX can offer conveniently fast and low-cost bill payments online.

When you need to pay overseas invoices, compare the different methods to discover which is best suited to your particular needs.

| FAQs | Answers |

|---|---|

| What is the best way to pay invoices internationally? | Each payment method has different pros and cons and which option is best for you depends on your needs. You can choose to make an international transfer with a provider like Wise and OFX, set up an international business bank account, or pay by credit card. |

| Can I pay an international invoice with a credit card? | Many card providers allow you to pay invoices using a credit card. This guide has pros and cons of paying by credit cards, and when it's a good option. |

| What is the safest payment method for international payments? | Most international money transfer providers employ security features to keep transactions and personal information safe. However, you should always be wary of suspicious websites or activity when paying overseas bills online. |