How to open a business account in Ireland from the UK

If you have a business in Ireland - or if you’re thinking of opening a business there - you’ll need a good way to manage your business finances in EUR. While there’s no legal reason a non-resident can’t open a business bank account in Ireland, you may find that non-bank alternative accounts are easier to operate and offer a more flexible service for non-resident customers.

In this guide, we’ll look at some of the best business account options available, from banks and non-bank alternatives like Wise and Revolut. Plus we cover how to open a business account in Ireland without going there.

Key points: Irish business account

Irish banks may allow non-resident business owners to open accounts, but the available services do vary depending on your entity type

The accounts available to you may depend on where you live and where your business is registered for example

Usually only sole traders can open an account with an Irish bank online

You may find you can get an easier account opening, verification and onboarding process from a non-bank alternative like Wise or Revolut

Non-bank services can often offer low fees, great rates and a strong range of supported currencies including EUR and GBP, so you can manage your business finances all in one place

Can I open a business bank account in Ireland as a non-resident?

Yes, you can open a business account in Ireland from the UK.

Some Irish banks offer services to non-resident business owners, but you’ll need to shop around, as many local banks prefer to reserve their services for larger corporate and institutional customers. It’s pretty common to need to visit a bank branch to register your account, which may also be inconvenient if you’re not a resident in Ireland.

As a great alternative, non-bank providers like Wise and Revolut have business accounts which can be opened from the UK, while still offering ways to send, receive, spend and receive euros.

Can I open a business bank account online in Ireland?

Yes, it is possible to open a business account online which can hold and receive EUR. However this option isn't always offered through Irish banks.

While sole traders are often able to open their accounts online, you’re likely to be asked to visit a branch in person if you have a different entity type. The exact process will vary depending on the specific situation and bank you pick.

Instead, you may want to pick Wise and Revolut., which both have fully digital application, verification and onboarding for business customers.

What is the best bank for a business account in Ireland?

There’s no single best Irish business account for UK business owners and entrepreneurs - the best bank will depend on your individual business needs. That means you’ll need to do a bit of leg work to research your bank and alternative provider options and compare the features available, so you can decide.

Here we’ve picked out 2 non-bank services available in Ireland, which support some services in EUR and GBP - Wise and Revolut, plus an Irish bank for comparison - AIB.

| Service/Provider | Wise business | Revolut business | AIB business account |

|---|---|---|---|

| Open account online | Yes - open entirely online or in app | Yes - open entirely online or in app | Sole traders can apply online - other entity types must apply in branch |

| Foreign currencies | 40+ including GBP and EUR | 25+ including GBP and EUR | EUR only |

| Account fees | 45 GBP one time opening fee No ongoing fee | No opening fee Monthly fee from 0 GBP - 79 GBP | No opening fee 4.5 EUR/quarter account fee |

| International transaction fees | From 0.33% | 5 GBP per payment Some account tigers offer a fixed number of no fee transfers monthly | Fees available by visiting a branch |

| Business debit cards | Available - Wise debit and expense cards | Available - Revolut corporate cards | Available - AIB business cards |

*Details correct at time of writing - 25th February 2025

Wise business account

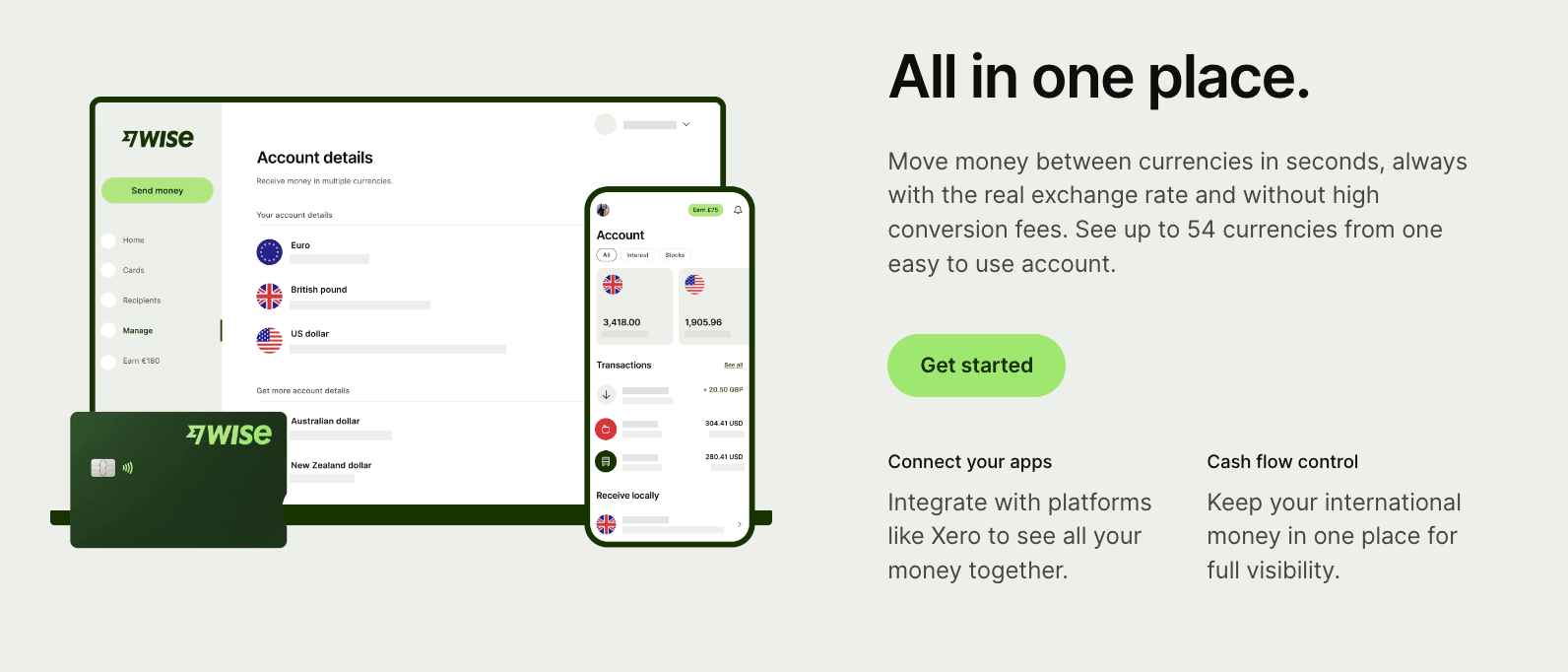

Great for: No ongoing fees, 40+ supported currencies, ways to receive payments conveniently in EUR and GBP

Wise offers business customers easy ways to open a powerful international account which supports GBP and EUR among 40+ currencies for holding and exchange. You’ll get ways to receive payments in foreign currencies directly, and can order debit and expense cards for you and your team. Plus you can make international transfers with the mid-market rate and low fees to 160+ countries, right from your phone.

Best features:

Hold, send, spend and receive GBP and EUR in one account

No ongoing fees, low and transparent transaction fees

Business extras like batch payments and accounting integrations

Go to Wise

Revolut business account

Great for: Choosing account tier to suit your needs, with ways to hold and exchange GBP and EUR, plus card and payment services

Revolut Business in has 3 account tiers, so you can select the one which offers you the best balance of cost and flexibility. The more basic account has fewer no fee transactions every month, making it better for smaller businesses, while larger businesses can trade up to get more no fee options and perks. Accounts support 25+ currencies with some monthly exchange that uses the Revolut rate with no extra fees, before a fair usage fee begins.

Best features:

25+ currencies available for holding an exchange including GBP and EUR

Select the account tier which suits your business size and stage

All accounts have some no fee currency conversion, transfers and other perks every month

AIB business account

Great for: Business bank account from a major Irish bank, which supports locally and internationally registered businesses

AIB has business account products which you can apply to with a business registered in Ireland, the EU or elsewhere. You may be able to open your account online if you’re a sole trader but people opening accounts for more complex entity types and businesses registered outside of Ireland are usually required to attend a branch in person. Accounts variable fees, including quarterly maintenance costs and transaction charges.

Best features:

Sole traders can get set up online for convenience

Hold and manage EUR conveniently in a local Irish bank account

As AIB is a bank, you’ll be able to get additional financial services easily if you need them

What is the process for opening a business bank account in Ireland?

The process for opening a business bank account in Ireland will vary depending on the provider you choose among other factors. Banks may let some customers apply digitally, but this is often only for sole traders, and will depend on the specific account and the supporting information and documents you’re able to provide. If you can't open your account online you’ll need to visit a branch with your paperwork in person.

Non-bank services usually allow you to apply online by uploading images of your documents for verification.

How to open a business account in Ireland online?

Often business owners need to visit a bank branch to open a business account. For a streamlined online account opening process you may find a non-bank provider like Wise or Revolut is your best bet. Providers like these have invested in creating frictionless processes to apply, get verified and start to transact - which means you can start with little more than your phone and your paperwork.

As an example, here’s a step by step overview of how to open a Wise Business account:

Download the Wise app, or open the Wise desktop site

Register with your email address, or an Apple, Google or FaceBook account and confirm you want a business account

Follow the prompts to enter your personal and business details

Upload your personal ID and address documents, and the required business paperwork for verification

Pay the one time account opening fee

Once your account is verified, you can order a card, set up currency balances and start transacting

Requirements to open a business bank account in Ireland

The requirements to open a business bank account in Ireland depend a lot on the bank or provider you select. Generally you’ll need to be a registered sole trader, or have a registered business - which may have to be in Ireland or the EU - and your company must comply with the bank or provider’s acceptable use policy. This often means that some types of business aren’t allowed, based on risk or legal issues.

What do you need to open a business bank account in Ireland?

You’ll always need to provide a set of documents to open an Irish business account, although what’s needed may depend on the provider and your business entity type. The way you present these to the provider will also vary - you may need to show originals in person or you may be able to upload images as evidence to support your application if you’re eligible for online account opening.

Here is a list of documents usually needed to open an Irish business account:

Passport or driving licence for all signatories

Proof of address like a utility bill for all signatories

Certificate of incorporation with the CRO

Certificate of Business Name

Company Constitution

Account mandate form

Details of the beneficial owners

If you’re a sole proprietor, you might need these documents:

Your passport or driving licence

Proof of address like a utility bill

Sample signature at a branch

Certificate of Business Name

Fees to open an Irish business account

Different banks and providers will have different fee structures for Irish business accounts. Some accounts are free to open but have monthly or quarterly fees, or you might come across accounts which don’t have monthly fees but which have a minimum balance requirement instead.

This means you'll need to read the terms and conditions of any account you’re considering very carefully to make sure you understand the one off and ongoing charges, and any penalties that may apply - for example, fall below fees if you do not maintain the minimum balance.

Conclusion: Opening an Irish business account

You’ll be able to open a business account which can hold and handle EUR as well as other currencies like GBP and USD, but you might find that the most flexible options don’t come from banks. Globally, many banks restrict access to non-resident services, which means that the accounts available are better suited to corporates and enterprise level organisations.

Non-bank services like Wise and Revolut can present a better option for startups, SMEs, sole traders and other business entity types looking for a low cost and flexible way to manage money across different currencies.

Use this guide to get some ideas about which EUR business accounts may suit your needs, to select the right one for your growing business.