Best business credit for card overseas travels (UK) in 2026

Having a credit card for business spending can make it easier to manage your cash flow, allowing employees to spend and reconcile business expenses conveniently. This can be especially helpful when business travel is needed, with credit cards which offer reward earning options and complimentary insurance popular with business owners and employees alike.

In this guide we’ll look at some of the best UK business credit cards you can take with you on your travels, and the positives and negatives for each one. We’ll also introduce some alternatives to a business credit card, in case you’re not sure which card type is right for you.

Here are the UK business credit cards for travel we cover:

1. American Express British Airways Accelerating card - good for earning Avios points and business rewards to redeem on travel, plus travel insurance options included

2. Santander Business Cashback credit card - good for no foreign transaction fee, with cash back earning opportunities as you spend

3. Barclaycard Business Select Cashback Credit Card - good for cash back, business perks and a free annual cloud accounting plan

Business debit card alternatives:

If your business doesn't qualify for a business credit card yet or if you’d rather manage your travel spending using a low cost business debit card, there are great alternatives for overseas travels:

Wise business card

Open a Wise Business account online or in the Wise app, to hold 40+ currencies, and order debit and expense cards for you and your team. Cards have no ongoing fees and there’s no foreign transaction charge for spending when you’re overseas. If you hold the balance you need in your account it’s free to spend - and if you don’t have the currency you need, your card will convert for you using the mid-market rate and low, transparent fees at the point of payment.

Wise cards also offer some free ATM withdrawals monthly before Wise ATM fees begin.

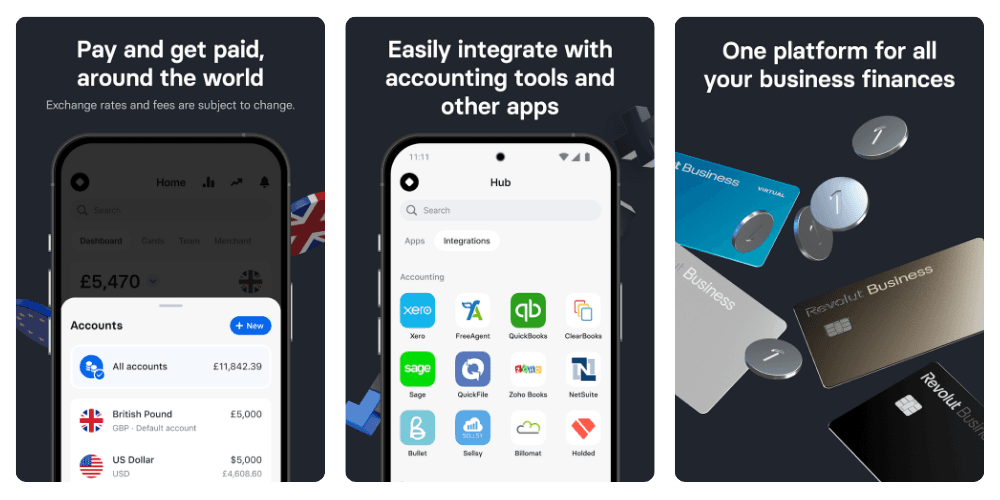

Revolut business card

Revolut offers business customers in the UK the choice of 4 different account plans with fees from 0 GBP to 79 GBP monthly. All plans offer linked debit cards and can hold and exchange 25+ currencies. Depending on the plan you pick you can get some no fee currency conversion monthly, before fair usage fees apply. Revolut accounts also offer business perks like local and international transfers.

Revolut business cards have a 2% fee when you use them in an ATM.

What are business travel credit cards?

Business travel credit cards can be issued for a business owner, or for approved employees, and typically come from a bank or from a card network like American Express.

Business travel credit cards work similarly to other credit cards, but are usually optimised for travel use - which can mean getting air miles or rewards as you spend, and other benefits like lounge access and free insurance for business travel. Generally business travel credit cards have been designed to meet the needs of relatively frequent travelers, including lifestyle benefits and business friendly features. They can also have pretty high annual fees and interest rates which you’ll need to weigh up when choosing the right card for your needs.

Pros and cons of business travel credit cards

| Pros of business travel credit cards | Cons of business travel credit cards |

✅Make it easier for employees to pay for business travel, and reconcile expenses ✅Cards are usually available for both business owners and employees ✅Spread the costs of travel over months if you choose to ✅Cards offer perks like rewards, air miles, lounge access and insurance in many cases | ❌ Relatively high annual fees can apply ❌Interest rates can be high, and cash advance fees are also likely to apply ❌Strict eligibility criteria are used ❌Overseas spending may cost more due to foreign transaction fees |

Business credit vs debit cards compared

To give a bit more of an insight, let's take a head to head comparison of all the providers we mentioned above, looking at some important features:

| Provider | Type | International withdrawal fee | Credit card interest rate | POS fees | Exchange rate |

|---|---|---|---|---|---|

| Wise | Business Debit | 2 withdrawals to 200 GBP/month free* - then 0.5 GBP + 1.75% | Not applicable | Free to spend a currency you hold in your account | Mid-market rate with variable conversion fee |

| Revolut | Business Debit | 2% | Not applicable | No fee to spend a currency you hold in your account | Revolut rate to plan limit, then 0.6% 1% out of hours fee |

| American Express British Airways card | Business credit | 3% | Simple Rate 24.84% | No POS fee to spend in GBP | Network rate + 2.99% |

| Santander Business Cashback credit card | Business credit | 3% | 23.7% APR | No POS fee to spend in GBP | Network rate |

| Barclaycard Business Credit Card | Business credit | 3% | 26.8% APR | No POS fee to spend in GBP | Network rate + 2.99% |

*Details correct at time of research - 11th February 2025

*Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks

Should you use a credit card or debit card for overseas travel?

There’s no correct answer here - it’ll depend on your specific needs and preferences.

A credit card is handy if you would rather pay for your travel over a few months. Credit cards are also often accepted as a payment guarantee - when you hire a vehicle or check into a hotel for example. Credit cards can come with some great perks - but you will need to weigh up the downsides, which can include far higher costs compared to using a debit card. Look at the foreign transaction fees, interest and how penalties are applied before you sign up.

Debit cards can be cheaper to use, and if you have a card which is linked to a multi-currency account overseas, spending can be simple and cheap too. However, you’ll need to have the funds immediately available in the account for spending, which can be a downside, plus rewards and perks may be limited compared to credit cards.

What is the difference between travel debit cards and credit cards?

A travel debit card may be linked to a multi-currency account which lets you hold foreign currencies in advance of travel and spend with no additional fees once you’re overseas. Travel debit cards can often have low costs, but they do require you to have funds available for spending in advance which can make it harder to manage your cash flow.

A travel credit card lets you spend to the card limit and then repay at a later stage, either within the grace period if you want to avoid interest, or with additional fees applied. Travel credit cards have annual fees in most cases and can also have pretty high interest and penalties, but you won’t need to have all the funds for your trip in advance of heading off as you can pay your bill back later.

How much does a business credit card cost?

Business credit cards have variable fees so you’ll need to take a good look at the card’s fee schedule before you start to spend. Here’s what to look out for:

Annual fee - plus any extra fees if you issue cards for your employees

Interest rate for spending and cash advances

Cash advance fee when you use your card at an ATM

Foreign transaction fee which applies on overseas spending

Penalty fees if you’re late paying your bill

Is there an international business credit card with no fees?

You’ll struggle to find a business credit card with absolutely no fees. You may want to look out for cards with no annual fees - if you then repay your bill in full and on time, and avoid overseas use, you may be able to limit the costs of spending with your card.

Which is the best business credit card for overseas travel?

Next, we’ll take a closer look at each of the credit cards we’ve touched on so far, so you can see if any suit your needs.

American Express British Airways Accelerating card

The American Express British Airways Accelerating card is issued directly by the network in association with British Airways, and has an annual fee of 250 GBP. You can earn Avios points to redeem against flights, and business points with Amex which can be redeemed for things like upgrades to your travel class if you’re using BA. Cards also offer up to 250,000 GBP travel accident benefit and insurance against inconveniences like missed or delayed flights.

Santander Business Cashback credit card

The Santander Business Cashback credit card has a low annual fee of 30 GBP with no extra charge for additional cards. There are no foreign transaction fees for overseas spending and you can get up to 1% cash back, too. There’s no cap on the amount of cashback you can earn - but do bear in mind that to get this card you must also have one of the eligible Santander business current accounts, which can incur their own fees.

Barclaycard Business Select Cashback Credit Card

The Barclaycard Business Select Cashback Credit Card has no annual fee, and offers up to 1% cashback and a cloud accounting subscription as part of the package. You can also get hand picked business friendly perks, which can make this a good choice. Bear in mind that even though there’s no annual fee to pay, other charges including a foreign transaction fee and a non-sterling cash fee do apply, which can make overseas spending more expensive.

FAQ on best debit cards for overseas travel

What is a travel debit card?

A travel debit card works like any other debit card but is optimised for travel. This may mean it's linked to a multi-currency account which lets you hold foreign currencies and spend overseas with low or no additional costs.

How to choose a debit card for overseas travel?

If you’re picking a debit card for overseas travel, choose one which has no ongoing fees to avoid unnecessary costs in between trips. You may also benefit from a card which has a linked account with a very broad range of currencies, like the Wise Business account and card.

Which debit card is best for travel?

There’s no best debit card for travel, it simply depends on your personal needs and preferences. The debit cards we have covered here all offer multi-currency business accounts which you can use to hold and spend foreign currencies. Compare a few options like Wise and Revolut, to see which suits you.

How do I make my debit card international?

Some banks ask you to turn on international features on your debit card, for security. Check if your bank has this requirement before you first travel - or choose a specific international debit card from a provider like Wise which has no extra step required before international use.

What is the best way to pay when travelling abroad?

Often paying with a card is the most convenient option when you travel for work, and both a debit and a credit card can be helpful in different scenarios. Consider getting both to cover you in all eventualities.